Latest News

A report of a current event, knowledge, information

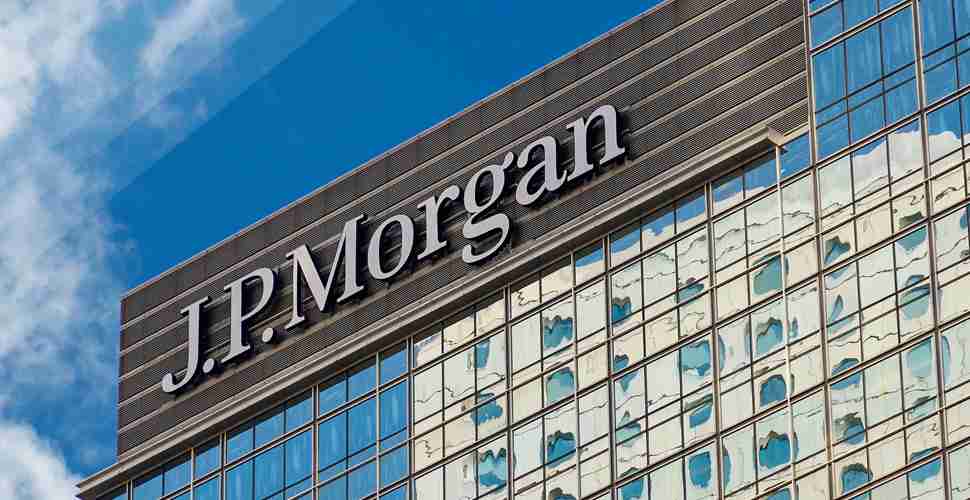

JPMorgan Is Stockpiling Cash - CEO Claims There’s a ‘Very Good Chance Inflation Will Be More Than Transitory

Investment financial institution JPMorgan Chase is stockpiling coins consistent with the company’s CEO Jamie Dimon. The funding banker doesn’t appear to consider inflation as “transitory†and he thinks there’s an “excellent threat†inflation should stick around.

At the give up of April, Bitcoin.com News stated at the Federal Open Market Committee (FOMC) and defined how FOMC individuals stated the benchmark hobby fee might be saved close to zero. Moreover, individuals of the FOMC additionally stated the committee wasn’t too worried approximately inflation, however, admitted inflation may also have “transitory effects†on the American economy.

JPMorgan Chase’s boss doesn’t consider that is the case, consistent with his current statements. While telling the general public he warned humans approximately cryptocurrencies on the give up of May, Dimon these days warned of runaway inflation, along with Larry Summers’ inflation predictions.

On Monday all through a conference, Dimon reiterated his inflation forecast and cited that his monetary organization was “efficiently stockpiling†coins. The cause JPMorgan Chase is hoarding coins is due to the fact Dimon thinks inflation won’t be brief.

“We have a variety of coins and functionality and we’re going to be very patient, due to the fact I assume you've got got an excellent threat inflation might be extra than transitory,†Dimon defined at the conference. Dimon in addition asserted that JPMorgan Chase might be organized for incoming inflation degrees and better costs.

“If you study our stability sheet, we have $500 billion in coins, we’ve genuinely been efficiently stockpiling increasingly coins watching for possibilities to make investments at better costs,†Dimon confused. “I do assume to look better costs and extra inflation, and we’re organized for that.â€

Macro Analyst Sven Henrich: ‘The Fed Has Skewed Wealth Inequality to Unjustifiable Levels’

Dimon isn't the best funding rich person who believes inflation may also sluggish the American economy, as many others have warned approximately the Federal Reserve’s economic easing policy. The founding father of northmantrader.com Sven Henrich keeps criticizing the U.S. significant financial institution’s behavior.

“The Fed has skewed wealth inequality to unjustifiable degrees whilst making [the] fee of dwelling an increasing number of unaffordable for many, and in the procedure have blown an ancient asset bubble that, if and while it blows up, will harm everyone,†Henrich stated on Tuesday. Henrich introduced his scathing grievance by saying:

The institutional vanity is mind-boggling and there does now no longer seem everybody on that Fed board with any spine and feel of duty to get up and say: Enough.

On Monday, the founding father of asset control company Tudor Investment Corp., Paul Tudor Jones, additionally indicated disapproval for the Federal Reserve’s loss of inflation concerns. Jones basically cited that the U.S. significant financial institution’s credibility is at stake if inflation isn't brief as FOMC individuals predict. Billionaire Stanley Druckenmiller instructed CNBC closing week that buyers might forget about inflation “till the Fed stops canceling marketplace signals.â€

In some other communication all through the printed Closing Bell, Morgan Stanley CEO James Gorman instructed CNBC’s Wilfred Frost that he doesn’t consider inflation might be transitory and the Federal Reserve’s hand can be pressured to elevate hobby costs.

“The query is while does the Fed flow?†Gorman remarked. “It has to transport at a few point, and I assume the unfairness is much more likely in advance than what the cutting-edge dots suggest, in place of later,†Morgan Stanley’s CEO introduced.

Peter Schiff thinks It’s Strange Finance Firms Are Stockpiling Greenbacks Rather Than Gold

Gold trojan horse and economist Peter Schiff thinks that the American populace, however, seems “to be even extra assured now that inflation is transitory than they had been earlier than we were given all this truly awful data.†Instead of stockpiling greenbacks, like JPMorgan Chase’s boss Jamie Dimon is doing, Schiff's exact he might anticipate bucks might be ditched so one can get away from falling values.

“The fact is, if you have inflation, what truly has to be going on is buyers have to be promoting bucks due to the fact they’re dropping value,†Schiff stated on his podcast on Tuesday. “They have to be promoting bonds even quicker due to the fact they constitute bucks withinside the destiny, so as to be really well worth even much less than bucks withinside the present. And you have to be shopping for gold as a hedge in opposition to that inflation.â€

Schiff confused that proper now the other is taking place, and he stated he surely doesn’t recognize why agencies are stockpiling greenbacks. Of course, the economist shilled his favorite brilliant yellow commodity at the podcast as well and stated clever humans will buy gold as a hedge in opposition to this monetary disaster.

“In the lengthy run, everybody who genuinely is aware the importance of what’s taking place might be taking gain of those marketplace movements to promote bucks into the rally and purchase gold into the dip due to the fact the larger movements manifestly are going to be down withinside the dollar, manner down in U.S. Treasuries, which constitute destiny bills of bucks, and a large flow up in gold,†Schiff concluded.

Related News

Bitcoin becoming less-risky as an investment, Novogratz says

Brazil is prepping an IPO for its state-run digital bank

Indian bank to offer crypto services across its 34 branches

The blockchain revolution is already here, say Alex and Don Tapscott

‘The cryptoruble is the future’ says Russian policymaker

Bitcoin’s Price Must Pass $40K to Halt Exodus of Traders:

Cape Cod's Largest Hospital Gets Bitcoin Donations Worth $800K

Spain May Soon Regulate “Risky†Bitcoin Street Ads

Brazil Approves First Latam Based Ethereum ETF

Google's New Cryptocurrency Ad Policy Goes Into Effect

Second Largest U.S. Mortgage Lender to Take Bitcoin Payments

Central Bank of Brazil Researches Creation of Digital Real

14 Suspects in Cryptocurrency Investment Scam Arrested in Taiwan

India Central Bank RBI Still Has Serious Concerns About Cryptocurrency

UK Post Office Adds Option to Buy Bitcoin via Easyid App

Bank of Russia Lists Crypto Companies Among Financial Pyramids

Major Cryptocurrency Exchanges Explore Entering Indian Crypto Market

Thailand to Develop Cryptourism Considers Issuing Utility Token

Grayscale Confirms Plan to Convert GBTC Into Bitcoin ETF

Goldman Sachs Predicts Ethereum Could Hit Dollar 8000 This Year

Indiana Star Bank Launches Bitcoin Trading Services

Venezuelan Court Rolls Back Seizure of More Than 1000 Bitcoin Miners

Bitcoin Dominance Slides Below 40 Percent for First Time in 6 Months

Leading Supermarket Chain in Croatia Introduces Crypto Payments

ECB Paper Marks Success Factors for CBDCs Digital Euro

Dogecoin Soars After Elon Musk Announces Tesla Will Accept DOGE

Leading Supermarket Chain in Croatia Introduces Crypto Payments

Chinas Xinhua News Agency to Issue NFTs Despite Crackdown on Crypto

Former Finance Secretary Doubts Indian Government Understands Crypto

Indian Authorities Raid Cryptocurrency Exchanges for Tax Evasion

Crypto Tops Investor Threats for US Securities Regulators

New Spanish Regulations to Target Crypto Investment Ads

Crypto Users and Exchanges Must Now Report Transactions in Colombia

Colombia Registers First Real Estate Purchase With Bitcoin

Indian Parliament Member Clarifies Legal Status of Cryptocurrency

Wells Fargo Cryptocurrency Has Entered Hyper Adoption Phase

Venezuela Might Have Cryptocurrency ATMs Again Soon

US Senators Working on Broad-Based Crypto Regulation

Abkhazia Extends Crypto Mining Ban Till End of Year

Is Bitcoin Heading Towards $25,000?

When is Cardano's next huge update coming?

How to recognize the best acquiring games?

What Is Proof Of Time and How It Works?

Ripple Exec - XRP was created as a "better Bitcoin"?

Wormhole Bridge further develops interoperability for Klaytn

Cryptocurrencies Explained Robo Inu Finance

BabyDoge Price in Green as Swap Testnet Finally Goes Live

Tether Is Setting New Standards For Communication

What Is Topgainer Complete Guide and Review About Topgainer

FTX US Lied About FDIC-Insured Products

LATOKEN Review The Ultimate Guide 2022

NFT Security 101 With Ledger x NFTevening

BTC Must Reach 1 Billion Wallets To Hedge Inflation

BORA Price Prediction 2022, 2023, 2024, 2025: Will BORA Go Up

Kryptomon To Launch An Exclusive Physital NFT Collection On Binance NFT

Will Ethereum Merge Buy the Crypto Market?

The Best Crypto Podcast: Top 5 to Check

Driving Bitcoin Adoption At Silverstone – Bitcoin Magazine

How To Denominate In Bitcoin Terms – Bitcoin Magazine

What’s Better: Privacy Coins or Bitcoin Privacy Tools?

Bitcoin below dollar 21000, Ethereum hold above dollar 1,500

Everything you need to know about mining crypto on a smartphone

Technical Indicators Suggest That BTC Has Established Its Bottom

Bitcoin, Ethereum and other fall, Polygon jumps

.jpg)

Will The Next Genesis Crypto Brokerage Fail?

.jpg)

Why dogecoin price is up today while other cryptos are trading low

.jpg)

Bitcoin Swings Below $17,000, Ethereum and Other Crypto Tokens Fall

.jpg)

Bitcoin, Ether, Solana, Other Crypto Prices Are Rising Today

.jpg)

Bitcoin over $17,000; Dogecoin, Solana and Shiba Inu fell up to 9%

.jpg)

How to start trading Crypto Markets

(1).jpg)

Bitcoin hits a one-month higher than expected US price

.jpg)

Price of Cardano (ADA) Will Experience Massive Drop as 2022 Ends

.jpg)

BTC Below $16,880 Support; Will It Follow a Positive Traction?

.jpg)

Top Trending Crypto on Binance, BNB Ousts Bitcoin on Second Position

.jpg)

Litecoin (LTC) Surpasses Shiba Inu (SHIB) in Market Cap

The presence of Bitcoin in the market is reaching all the time

3 good signs for the crypto industry in 2023

(1).jpg)

Bitcoin, Ethereum down 1%, other tokens fell

(6).jpg)

Latest Cryptocurrency Prices: Bitcoin, Ethereum, other mixed tokens

FTX claims that US$415 million in cryptocurrency has been stolen

.jpg)

How much of FTX debt has so far been recovered?

(1).jpg)

Over $3.8 billion will be stolen in cryptocurrency hacks in 2022

(2).jpg)

Bitcoin Exceeds $24,000 for the First Time Since June 20, 2022

(1).jpg)

Crypto Price Today: Coins like Bitcoin, Ethereum, and others decline

(5).webp)

Forecast of the Bitcoin price as BTC Rises 2.2%

What Will WBTC Worth In 2025

Bull Run Predicted To Continue For Bitcoin And Ethereum

.webp)

Bitcoin stays above $28,000 as Ethereum gains around 2%

Top Long-Term Cryptocurrency Investments

.webp)

Top Coins Land In Greens As Bitcoin Exceeds $28,000

Gains for Bitcoin, Ethereum, and other tokens

Bitcoin makes some progress, with Bitcoin SV leading the way

.webp)

Memecoin PEPE Becomes Top Gainer As Greens Dominate Charts

.webp)

Bitcoin and Ethereum underperform; XDC outperforms them all

.webp)

Bitcoin Is Still Under $30,000, but HBAR Is the Top Gainer

.webp)

Top Coins Land In The Red But Bitcoin Remains Above $27,000

After a court supports a grayscale ETF, bitcoin increases

.webp)

Bitcoin is still trading below $26,000, while Astar is the top gainer

Axie Infinity overtakes all other gainers as Bitcoin holds above $26,000

.webp)

Axie Infinity overtakes all other gainers as Bitcoin holds above $26,000

.webp)

Bitcoin Surpasses $27,000, with Flare the Top Gainer

.webp)

The top gainer as Bitcoin drops below $27,000 is Terra Classic

.webp)

Over the weekend, Bitcoin remains below $27,000

.webp)

Top Coins Like Bitcoin, Ethereum, and Others Land In Reds

.webp)

Bitcoin Cash surpasses $1,600 as Ethereum crosses it

PEPE is the biggest loser when Bitcoin Falls Below $28,000

.webp)

Ethereum, Bitcoin, and Other Popular Coins Drop in Value

.webp)

Ethereum, Bitcoin, and Other Popular Coins Drop in Value

Related CryptoCurrencies

© 2024 WBTC Price All Rights Reserved.

-min.jpg)

(1)-min.jpg)

-min.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

-Offering-Risks-Retirement-Security-of-Americans,-Says-Labor-Department-Official.jpg)

.jpg)

.jpg)

-cost-might-ascend to-doller-0.08-level.png)

-min.jpg)

.jpg)

.jpg)

(5).jpg)

(1).jpg)

.jpg)

.jpg)

.jpg)

(3).jpg)

(2).jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

(1).jpg)

(2).jpg)

(1).jpg)

(2).jpg)

(4).jpg)

(1).webp)

(3).webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

(2).webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

White Bitcoin

White Bitcoin Bitcoin

Bitcoin Bitcoin Cash

Bitcoin Cash Bitcoin SV

Bitcoin SV Bitcoin Gold

Bitcoin Gold