Latest News

A report of a current event, knowledge, information.

Nov 20,2021

Bank of England Governor Warns Crypto Is Providing Means of Payment for Criminals

Bank of England Governor Andrew Bailey has cautioned that crypto resources are giving one more method for installment to individuals who need to direct crime.Bank of England Governor Andrew Bailey Sees Crypto Helping Criminal ActivitiesThe legislative leader of the Bank of England, Andrew Bailey, said during a web-based interactive discussion coordinated by the British national bank that the ascent of digital money is helping criminal operations. He was cited as saying:The approach of the advanced method for installment, and specifically crypto resources, I'm worried about the possibility that the proof recommends … that it is giving one more method for installment to individuals who need to direct crime.Lead representative Bailey has cautioned about different parts of cryptographic money on a few events. He said in May: "I'm doubtful about crypto-resources, honestly, in light of the fact that they're hazardous and there's a tremendous excitement out there."He likewise expressed that digital forms of money "have no characteristic worth." However, the Bank of England lead representative added that it doesn't mean individuals don't put esteem on them, taking note of that "they can have extraneous worth." Nonetheless, Bailey stressed: "I will say this obtusely once more. Get them provided that you're ready to lose all your cash."The Bank of England lead representative isn't the just one stressed over crypto being utilized in unlawful exercises. The leader of the European Central Bank (ECB), Christine Lagarde, said in May that digital currencies are inclined to tax evasion.U.S. Depository Secretary Janet Yellen has discussed crypto being utilized in illegal financing a few times this year. In February, she focused on the significance of crypto guidelines to guarantee bitcoin and digital currencies are not utilized in unlawful exchanges.Besides, U.S. President Joe Biden said in October: "The United States will unite 30 nations to speed up our participation in fighting cybercrime, further developing law authorization cooperation, stemming the unlawful utilization of cryptographic money, and drawing in on these issues strategically."

Read More

Nov 19,2021

Largest Stablecoin by Market Cap Tether Launches on the Avalanche Network

The biggest stablecoin by market upper casing, tie has reported the dispatch of ties on the Avalanche blockchain convention. The stablecoin tie has dispatched a heap of blockchain organizations and today there are more than 74.8 billion ties available for use today.Tie Launches on AvalancheOn Wednesday, Tether Operations Limited, the firm that issues the stablecoin resource tie (USDT) has reported the dispatch of USDT on Avalanche (AVAX). The crypto trade Bitfinex has additionally uncovered it will uphold Avalanche-local USDT tokens on the trade.Torrential slide (AVAX) is a brilliant agreement stage that is both viable and a contender of the blockchain convention Ethereum (ETH). "Tie's symbolic's dispatch on Avalanche will expect to help the drawn-out development and manageability of the Avalanche organization while driving stablecoin utilization across the defi biological system," the organization clarified on Wednesday."USDT on Avalanche is a fundamental structure block for DeFi clients," Emin Gün Sirer, the overseer of the Avalanche Foundation clarified in an assertion. "Tie has turned into a very much acknowledged, reliable stablecoin with broad help all through trades. It will be much more remarkable with Avalanche as its establishment," the Avalanche Foundation chief added.In the course of the most recent 30 days, the local resource on the Avalanche chain (AVAX) has expanded in esteem by 59.9%, and year-to-date, AVAX has expanded by 2,554% in esteem. Measurements from defillama.com's defi dashboard show Avalanche has $10.45 billion complete worth secured Defi conventions today.Tie's hold straightforwardness page takes note of that as of November 10, 2021, there are around 74,863,439,905 ties (USDT) in presence. "We're eager to dispatch USDT on Avalanche, offering its developing and energetic local area admittance to the most fluid, stable, and trusted stablecoin in the advanced symbolic space," Paolo Ardoino, the CTO at Tether commented during the declaration.The tie is as of now given on blockchain organizations like Omni Layer, Ethereum, Algorand, Bitcoin Cash, EOS, Liquid, Solana, and Tron."For the individuals who have faith in the improvement of Layer-1 blockchain stages Avalanche addresses an advanced task that flaunts Ethereum Virtual Machine similarity and could be a fundamental driver for engineers hoping to port decentralized applications over from Ethereum," Ardoino added.The second-biggest stablecoin by market capitalization, USD coin (USDC) likewise has plans to be given on a heap of various blockchain networks. USDC has a market valuation of around $34.6 billion and there's $145 billion in stablecoins today.Both tie (USDT) and usd coin (USDC) rule the market as far as market capitalization. Today, the ties available for use address 51% of the $145 billion stablecoin economies.

Read More

Nov 18,2021

1000 Bitcoin From 2010 Worth Dollar 68M Mystery Whale Returns Moving a String of 20 Decade Old BTC Block Rewards

154 days prior, a secret bitcoin mining substance spent a line of 20 square compensations from 2010 that sat inactive for well longer than 10 years. Our newsdesk has been examining this bitcoin whale's activities since getting the substance in 2020. Presently after the June ninth appearance, on November 10, the secret whale got back to spend another 1,000 bitcoin coming from 20 square rewards mined over ten years prior.1,000 'Resting Bitcoins' Worth $68 Million From 2010 Wake After a Decade of HibernationLast year, following the market gore on March 12, 2020, also called 'Dark Thursday,' Bitcoin.com News found a huge whale burning through 20 continuous square prizes straight coming from blocks mined way back in 2010. From here, like Herman Melville's Captain Ahab, our examination drove our newsdesk to find a heap of whale sightings, as enormous amounts of 2010 bitcoin (BTC) block reward strings were spent in 2020 and 2021 too.As indicated by our course of events, the element went through multi decade-old bitcoin block prizes on March 12, 2020, October 11, 2020, November 7, 2020, November 8, 2020, December 27, 2020, January 3, 2021 (Bitcoin's twelfth commemoration), January 10, 2021, January 25, 2021, February 28, 2021, March 23, 2021, and June 9, 2021. Presently, after five months, on November 10, 2021, the secret whale has indeed moved multi decade-old bitcoin block rewards, burning through 1,000 BTC at block tallness 709,029.The 1,000 bitcoins from 2010 moved on November 10 were found by a Bitcoin blockchain parsing apparatus Bitcoin.com News influences called Btcparser.com. The 20-block-reward spend occurred on early Wednesday morning at a touch after 1:30 a.m. (ET). The exchange of the 1,000 purported 'resting bitcoins' likewise followed precisely the same examples as the whale's past spends demonstrating that it is possible the equivalent bitcoin mining substance.These specific square rewards were mined in 2010 during the long periods of August, September, and October. Another comparability is the way that this digger has gone through the relating bitcoin cash (BCH) attached to the first 2010 bitcoin (BTC) addresses. The 1,000 BCH was moved at Bitcoin Cash block tallness 713,430. The BCH was gone through approximately an hour after the BTC was moved and the bitcoinsv (BSV) attached to the coins stay inactive. The secret 2010 mining whale has followed this daily practice during each and every 20-block-reward string spend.Whale Is Possibly Transferring to an Escrow Account or Coins Could Be Held as 'Virgin Bitcoins' for VIP Exchange ClientsBesides, the whale then, at that point, solidified the 1,000 BTC into one location (very much like every one of the occasions previously) and the coins are then dispersed into wallets with 10 BTC each. The whale additionally merged the 1,000 BCH and afterward the coins were parted into groups of 50 BCH per wallet. Talking with Bitcoin.com News, the maker of Btcparser.com accepts the coins may be going to an escrow account. "That P2SH address seems as though an escrow account," he said. "When bitcoins are gotten, the past proprietor gets compensated and later the new proprietor starts his circulation among numerous 10 BTC wallets," the onchain analyst added.The dissemination additionally appears as though the coins might have been moved to a trade. On January 27, 2021, Bitcoin.com News and other onchain analysts expected it was conceivable that Coinbase was the last beneficiary of these 'neglected bitcoins' from 2010. Basically, the bunches of 10 BTC could be held by a trade and alluded to as "pockets for withdrawal."The coins might actually be held for the crypto trade's VIP client base as the coins are considered 'virgin bitcoins.' There's been a longstanding talk that 'virgin bitcoins' can bring a premium of over 20% over the spot cost. 'Virgin bitcoins' are coins that have been mined however have never been related to different exchanges and bitcoins fastened to horrible activities.The cryptographic money local area has no clue about who the 2010 excavator is nevertheless it is very clear the element mined an extraordinary amount of bitcoin in the good 'ol days. The present exchange of 1,000 supposed 'resting bitcoins' was valued at $68.4 million at the hour of move and the bitcoin cash (BCH) spent was valued at $712,070.It's likewise important that the expressions "spent" or "spend" in this article, don't really imply that the bitcoins were "sold" to an outsider for fiat or another crypto resource. The line of 20 square rewards and the 1,000 bitcoins filtered into wallets with 10 BTC per wallet could in any case have a place with the first proprietor.

Read More

Nov 17,2021

Venezuelan Court Rolls Back Seizure of More Than 1000 Bitcoin Miners

A Venezuelan court in the capital of the nation has moved back capture of in excess of 1,000 Bitcoin excavators because of anomalies that happened during the seizure. As per court records, the gear that was seized was in the guardianship of an outsider organization that was doing upkeep administrations. The court requested Sunacrip, the public crypto guard dog, to recover these diggers from their proprietors.Venezuelan Court Decides On Crypto Seizure CaseA Venezuelan court situated in the capital of the nation has chosen to move back a seizure measure that the public digital money guard dog, Sunacrip, executed a month ago. The activity, which was completed in a joint exertion by the logical policy of the nation and Sunacrip, introduced a few anomalies and as indicated by court reports, disregarded the "right to protection and fair treatment, just as the right to property of the offended party organization."The hardware seized was going through support by outsiders and the activity examined these organizations, taking 12 Antminer S9-S9Is, 1,624 EBANG E9Is, and 1,475 power sources into guardianship. Be that as it may, Sunacrip didn't determine the area where these excavators were to be held.One more anomaly seen by the court is that this sort of method takes into account the necessary records to be introduced inside a window of 15 days. Be that as it may, for this situation, specialists held onto the gear around the same time.Courts Can Now Deal With These CasesWith the presentation of this sort of interest in Venezuelan enactment, there is currently a point of reference expressing that courts can for sure meddle in these cases in case there is the assumption of an infringement of the privileges of property, monetary opportunity, or fair treatment. The choice of the court expresses that this held onto hardware should be rewarded its proprietor, an organization called Sierramoros, who will have the authority over it until the matter is settled.One more intriguing component of the case is that on the grounds that the Sunacrip official who managed the activity didn't indicate the site where these excavators would be put away, the offended parties accept that these diggers could be being utilized by outsiders to mine bitcoin while the question of the case is tackled.The court requested that while Sierramoros is qualified to have guardianship of these diggers, it can't give them something to do until the continuous correction of its grants is shut.

Read More

Nov 16,2021

AMC Theatres on Track to Accept 4 Cryptocurrencies Next Month CEO Expects Dogecoin and Shiba Inu to Follow

The CEO of the world's biggest film presentation organization, AMC Entertainment, says that his organization is "on target" to acknowledge four digital forms of money by year-end. Dogecoin (DOGE) is relied upon to be included in the main quarter of the following year, and the organization is at present sorting out some way to take shiba inu (SHIB) as money.AMC Discusses Its Crypto Plans: Dogecoin, Shiba Inu IncludedAMC Entertainment Holdings (NYSE: AMC), otherwise known as AMC Theaters, gave an update of its crypto plans during the organization's Q3 profit call Monday.AMC is the biggest film presentation organization in the U.S., Europe, and the world. As of March 31, the organization claimed or worked roughly 950 theaters and 10,500 screens internationally."We began tolerating digital money for AMC gift vouchers and are encoding right currently to acknowledge digital currency for online installments on our site and portable application," AMC CEO Adam Aron clarified, explaining:We are on target right currently to acknowledge, as we guaranteed, bitcoin, ethereum, litecoin, bitcoin money, and others before year-end one month from now … We think we'll have the option to dispatch the acknowledgment of dogecoin in the main quarter of '22, only a couple of months from now.Prior to choosing to acknowledge dogecoin, the CEO set up a Twitter survey finding out if they needed AMC to acknowledge the image cryptographic money. The result was "interesting to the point that the organization promptly investigated tolerating DOGE. "We're currently sorting out some way to take dogecoin," Aron affirmed.Concerning AMC will acknowledge shiba inu (SHIB), Aron noticed that after his organization's underlying declaration about tolerating digital forms of money, "the surge of editorial came in about shiba inu."The CEO continued to set up another Twitter survey. This time he found out if AMC ought to acknowledge SHIB as a method for installment close by dogecoin and other cryptographic forms of money recently declared.Out of a sum of 153,100 votes, 87.6% said "OK." Aron portrayed, "A ton of you cast a ballot, and a ton of you casted a ballot yes," adding:We are currently sorting out how we can take shiba inu as money … That's the following one on our digital currency hip procession.Moreover, Aron noted: "While we will acknowledge cryptographic money, we won't hold it on our monetary record, and hence, won't confront expanded accounting report hazards."The CEO additionally uncovered that AMC is thinking about dispatching its own digital money. What's more, he affirmed that the organization is "in discussion with various significant Hollywood studios about the idea of joint wandering dedicatory NFTs [non-fungible tokens] identified with significant film titles that show in our theaters."The AMC CEO further shared:There's simply been a tsunami of inbound informing to our organization and to me by and by that we should get substantially more dynamic in the circle of digital currency and that there was genuine freedom for AMC.

Read More

Nov 15,2021

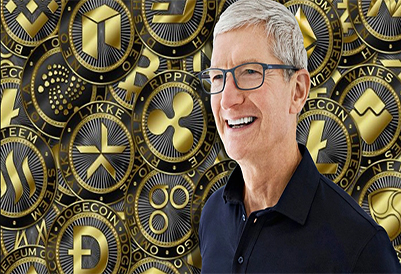

Apples CEO Owns Crypto Tim Cook Thinks Its Reasonable to Own as Part of a Diversified Portfolio

The CEO of the tech monster Apple, Tim Cook unveiled that he claims digital currency and said that he believes it's sensible to possess it as a feature of a broadened portfolio." Cook's assertions originated from an appearance with the New York Times Dealbook's host Andrew Ross Sorkin.Apple CEO Tim Cook Tells the Press He Owns Crypto and It's Something Apple Is 'Checking out'The digital money economy has been on a tear and as of late caught $3 trillion in esteem this week as bitcoin (BTC) and various other crypto resources arrived at untouched value highs. The worth of the crypto economy is presently more than $500 billion bigger than the market capitalization of Apple. The crypto economy additionally filled fundamentally quicker in esteem than the American worldwide innovation organization.In the interim, Apple's CEO revealed that he claims crypto and the chief thinks that its sensible to add to a portfolio. When inquired as to whether he claims crypto, Cook reacted: "I do. I believe it's sensible to claim it as a component of a differentiated portfolio." Furthermore, Cook was gotten some information about "conceivably tolerating [cryptocurrency] through Apple Pay or in any case." The Apple CEO answered:Um, it's something that we're checking out. It's not something we have prompt intends to do. I would kind of portray it as there are things that I wouldn't do like our money balance. I wouldn't go put that in crypto, not on the grounds that I wouldn't put my own cash in crypto, but since I don't think individuals purchase Apple stock to get openness to crypto.Cook Has Been Interested in Crypto for some time and Researches the SubjectOn Twitter, Microstrategy CEO Michael Saylor reacted to Cook's money balance proclamations and said: "If Apple somehow managed to add support for Bitcoin to the iPhone and convert their depository to a Bitcoin Standard, it would be valued at something like a trillion dollars to their investors." Many other advanced cash advocates shared the Apple CEO's assertions as they were amazingly satisfied to hear the innovation organization's leader contributes to the crypto can.After Cook said that he believes it's sensible to claim it as a piece of an enhanced portfolio, the Apple CEO further focused: "I'm not offering anyone venture guidance, coincidentally." Cook added that he's been exploring crypto for quite a while and he accepts it is fascinating."I've been keen on it for some time and I've, you know, been investigating it, etc. Thus I believe it's intriguing," Cook noted.

Read More

.jpg)

Nov 13,2021

US Treasury Sanctions 2nd Cryptocurrency Exchange DOJ Seizes Dollar 6.1 Million

The U.S. Depository Department has authorized a subsequent digital currency trade "for working with monetary exchanges for ransomware entertainers." Two ransomware administrators have likewise been endorsed and $6.1 million in reserves were seized.US Treasury Sanctions Another Cryptocurrency ExchangeThe U.S. Division of the Treasury declared Monday that its Office of Foreign Assets Control (OFAC) has authorized ransomware administrators and a digital money trade.Crypto trade Chatex and its related encouraging group of people have been endorsed "for working with monetary exchanges for ransomware entertainers," the Treasury states. "Examination of Chatex's realized exchanges demonstrate that over half are straightforwardly followed to unlawful or high hazard exercises, for example, darknet markets, high-hazard trades, and ransomware."Chatex has direct binds with Suex OTC, the first crypto trade authorized by the OFAC on Sept. 21, the Treasury noted.The OFAC additionally authorized Ukrainian Yaroslav Vasinskyi and Russian Yevgeniy Polyanin Monday "as far as it matters for them in propagating Sodinokibi/Revil ransomware occurrences against the United States." The Treasury added that the two are "important for a cybercriminal bunch that has occupied with ransomware exercises and gotten more than $200 million in recovery installments paid in bitcoin and monero.The Treasury clarified: "All property and interests in property of the assigned focuses on that are dependent upon U.S. purview are impeded, and U.S. people are by and large restricted from taking part in exchanges with them. Furthermore, any substances 50% or more possessed by at least one assigned people are likewise hindered."The declaration portrays:While most virtual money action is licit, virtual cash stays the essential instrument for ransomware installments, and certain corrupt virtual money trades are a significant piece of the ransomware biological system.DOJ Seizes $6.1 Million in Funds Held at FTX TradingThe U.S. Division of Justice (DOJ) autonomously reported Monday that it has seized $6.1 million from Polyanin, noticing that both Polyanin and Vasinskyi have been "accused of sending Sodinokibi/Revil ransomware to assault organizations and government substances in the United States."The $6.1 million in reserves seized are discernible to supposed payoff installments got by Polyanin, the Justice Department said. The assets were held in an "FTX Trading Limited record" for the sake of "Evegnii Igorevich Polianin" and additionally "Evgeniy Igorevich Polyanin," the DOJ's seizure warrant shows.As per blockchain examination firm Chainalysis, the two people got generous measures of digital currency. The firm definite that across totally authorized addresses named:Polyanin got more than $11.5 million worth of bitcoin and more than $2 million worth of USDT_ETH, while Vasinskyi got more than $900,000 worth of bitcoin.

Read More

Nov 12,2021

Latest West Africa Art Fair Features NFTs Organizers Highlight Importance of Blockchain

The coordinators of Art X Lagos, a West Africa workmanship presentation, as of late launched a non-fungible token (NFT) craftsmanship reasonable that includes crafted by African specialists drawn from in excess of six nations.Blockchain Provides Important Opportunity for ArtistsIn an assertion made on Art X Lagos' site, the coordinators contend that blockchain is presently giving advanced specialists a chance to sell their work. They added that such a change in perspective opens up the chance of a more decentralized and more community-oriented economy, where makers can lead the way towards a more comprehensive, and more assorted society.To show the degree of Art X Lagos' assurance, the coordinators, close by Super rare — an advanced workmanship market on the Ethereum blockchain — as of late launched the craftsmanship reasonable. As per a report, the actual form of this reasonable started on November 4 and was relied upon to end on November 7. The internet-based reasonable, then again, is relied upon to end on November 21.NFTs Getting More Support in AfricaIn the meantime, in their assertion, the coordinators likewise set aside to effort to clarify why they are particularly strong of NFTs. The assertion clarifies:As West Africa's first global workmanship is reasonable, Art X Lagos perceives the significance of adding to the advancement of our rich prospering African computerized craftsmanship scene, and with this task, we desire to give a brief look into the eventual fate of workmanship making and assortment on the mainland, while featuring the tremendous capability of NFTs in the improvement of Africa's innovative biological systems.Before the reasonable's initiation, a conspicuous Nigerian craftsman and co-caretaker of the show, Osinachi, was cited communicating his enthusiasm for the work Art X Lagos is doing to help Africa's advanced specialists.He added that he would utilize his own insight as an advanced craftsman to lay the foundation for the achievement of other African specialists who he says are ready to investigate the space.What are your considerations about this story? Let us know what you think in the remarks area beneath.

Read More

Nov 11,2021

As Bitcoin Soared Past Dollar 68K Plan B Says Floor Model Shows BTC Reaching Dollar 100K This Year

On November 8, 2021, the cost of bitcoin arrived at an untouched high of $68,564 per unit at 10:57 p.m. (ET) on Monday evening. In the interim, Plan B, the maker of the bitcoin value model called stock-to-stream (S2F), has effectively anticipated the most recent three months of bitcoin costs and as of late said that dependent on the floor model the cost will arrive at $100K this year.'Bitcoin Looking Strong' — Plan B's Poll Results Show 40% of Voters Believe $100K Will Happen This YearFour months prior in June, Plan B tweeted that his "the direst outcome imaginable for 2021" bitcoin (BTC) costs "on-chain based" would be "Aug>47K, Sep>43K, Oct>63K, Nov>98K, Dec>135K." During the main seven-day stretch of August, Plan B reconfirmed his trust in the value gauge and said "$64K was not the top."After accurately foreseeing the bitcoin costs for the long periods of August, September, and October, Plan B has been talking about BTC's present value run-up during the principal seven-day stretch of November. On November 3, Plan B tweeted that bitcoin's "Relative Strength Index [is] 72" and further noticed that "bitcoin [is] looking solid."After two days, Plan B distributed a survey inquiring as to whether they suspected bitcoin would reach "$500K, $288K (S2FX model), $100K (S2F model), or will BTC stay beneath $100K… by Christmas 2021?"The survey got 242,008 votes prior to shutting and 39.8% said it would arrive at $100K per unit. 31.4% of Plan B's electors who partook in the survey accept the cost could hit $288K, while 23.8% have the assessment that BTC will remain underneath $100K. 5% of the 242,008 votes accept there is a possibility BTC will hit $500K per unit.S2F Model Predicts $100K Average, S2FX Model Predicts $288K AverageThat very day the pseudo-unknown investigator further asked his devotees "Are you prepared for +$10K day by day candles?" after two days, Plan B said, "bitcoin long haul energy is rising quick."Around six hours before bitcoin (BTC) tapped an untouched high on Monday evening, Plan B indeed talked about the six-digit value forecast."As you most likely are aware S2F model predicts $100K normal for this dividing period (and in light of floor model we arrive at $100K this yr)," Plan B said. "Yet, S2FX model predicts $288K normal this cycle (we really want some genuine firecrackers in 2022 for that). How about we see where this second leg of the buyer market will take us," the expert added.

Read More

Nov 10,2021

Indiana Star Bank Launches Bitcoin Trading Services

Star Financial Bank (Star Bank) says it has turned into the principal bank in the U.S. province of Indiana to offer bitcoin administrations to clients. The administrations will be presented through the New York Digital Investment Group and Alkami stage. Clients will purchase and sell bitcoin by means of the Star Mobile Banking App.'First Bank in the State of Indiana to Offer Bitcoin Trading Services'Star Financial Bank (Star Bank) declared Tuesday:Star is eager to offer clients the capacity to purchase and sell bitcoin through the Star Mobile Banking App."We're dispatching this new contribution as a shut beta," the bank added.Star Bank is an Indiana-based local area bank. Its parent organization, Star Financial Group, has $2.80 billion in resources with 36 areas in focal and upper east Indiana, as per its site.The bitcoin administrations are given by the New York Digital Investment Group (NYDIG) through Alkami, a cloud-based computerized banking arrangements supplier for U.S. banks and credit associations. NYDIG is the bitcoin speculation arm of Stone Ridge Asset Management.As per the declaration distributed on Star Bank's site:Star Bank is the principal bank in the province of Indiana to offer bitcoin exchanging administrations to clients.The bank's clients will have the choice to "obtain, sell, hold, and oversee bitcoin close by their customary resources," the declaration subtleties.Alkami's originator and boss methodology and deals official, Stephen Bohanon, clarified that his organization "assists monetary foundations with making computerized banking progress by conveying the most exceptional cloud-put together advanced financial stage with respect to the market." He believed: "Early innovation adopters like the significance of embracing bitcoin openings."

Read More

Nov 09,2021

Indian Payments Giant Paytm Could Offer Bitcoin Services if Government Makes Crypto Legal Says CFO

Paytm, probably India's biggest installment organization is available to offer bitcoin administrations if the crypto resource becomes legitimate in the nation, as indicated by its CFO. On the off chance that bitcoin "was at any point to turn out to be completely lawful in the country, plainly there could be contributions we could dispatch," he said.Paytm Open to Bitcoin OfferingsPaytm Chief Financial Officer Madhur Deora has shown that his organization is available to offer bitcoin administrations if the crypto resource becomes legitimate in India, neighborhood media revealed Thursday, referring to his new meeting with Bloomberg TV.Deora was cited as saying:Bitcoin is as yet in an administrative ill-defined situation if not an administrative boycott in India. Right now Paytm doesn't do bitcoin. Assuming it was at any point to turn out to be completely lawful in the country, plainly there could be contributions we could dispatch.In August last year, Paytm apparently froze Paytm Payments Bank's client accounts associated with crypto exchanging.Paytm is right now India's second most important web organization. The organization is wanting to dispatch the first sale of stock (IPO) between Nov. 8 and Nov. 10. The IPO, which is relied upon to take the organization's valuation to $20 billion, is ready to turn into the greatest IPO throughout the entire existence of the Indian capital business sectors.The Indian government has been dealing with a cryptographic money bill for a long while. At first, the public authority was thinking about a bill to boycott cryptographic forms of money, like bitcoin. Notwithstanding, late reports propose that the public authority is presently intending to control the crypto area. The crypto enactment will be "particular and remarkable," one official said. Last month, Finance Ministry authorities supposedly said that crypto guidelines would no doubt come around by February.In the interim, the country's national bank, the Reserve Bank of India (RBI), actually has "genuine worries" about cryptographic money, which have been conveyed to the public authority. The RBI likewise said that an advanced rupee model might be uncovered before the year's over.

Read More

Nov 08,2021

BTC Futures Open Interest Continues to Rise Following Bitcoin ETF Listings Last Month

Bitcoin prospects open interest keeps on excess high after the dispatch of the first bitcoin trade exchanged asset (ETF) on October 22. While Binance orders $5.81 billion and stands out, CME Group stands firm on the second-biggest foothold as far as bitcoin fates open interest (OI) with $4.1 billion or 16.84% of the total OI.Top Ten Derivatives Platforms Command More Than 97% of Bitcoin Futures Open InterestBitcoin subsidiaries have expanded a lot lately, and following the dispatch of the Proshares and Valkyrie bitcoin prospects ETFs, bitcoin fates have seen critical market activity. After Valkyrie's ETF (Nasdaq:BTF) was dispatched, the examination bunch Skew tweeted that CME Group's bitcoin fates OI arrived at another record-breaking high.During the principal seven-day stretch of November, bitcoin prospects' open interest across all the crypto subordinates stages is $24.32 billion as per coinglass.com insights. The main ten subsidiaries stages offering bitcoin fates order $23.68 at least billion than 97% of the OI. The digital currency exchanging stage Binance is the innovator as far as bitcoin fates with $73 billion in worldwide volume among 54 unique crypto markets.CME Group's Bitcoin Futures Open Interest More Than 16% of Aggregate OIAs far as bitcoin prospects, Binance holds 5.81 billion in OI which represents 23.9% of all the BTC fates positions. In the interim, the world's biggest monetary subordinate trade, Chicago Mercantile Exchange (CME) Group, catches 16.84% or $4.1 billion in open interest.Leaving out Binance and CME Group, the best ten crypto subsidiaries stages as far as bitcoin prospects OI incorporate trades like FTX ($3.84B), Bybit ($3.63B), Okex ($2.21B), Deribit ($1.49B), Bitfinex ($827.71M), Bitmex ($752.43M), Bitget ($557.5M), and Huobi ($485.59M).Bitcoin ETF Markets Follow Spot Market TrendsAs far as crypto subordinates, 627 crypto fates, and perpetual no matter how you look at it, FTX holds the second-biggest worldwide volume beneath Binance with $13.4 billion out of 24 hours. Moreover, similar to bitcoin's (BTC) spot market solidification period, the bitcoin fates ETFs from Proshares (NYSE: BITO) and Valkyrie have followed comparative ways.While BITO traded at a high of $43.28 in October, shares are right now trading for $39.30. The trade exchanged asset BTF hit a high of $25.25 however is currently changing hands for $24.23.

Read More

Nov 06,2021

AWS Seeks a Specialist to Develop Amazons Digital Currency and Blockchain Strategy Roadmap

This previous summer the American global innovation organization, Amazon, distributed two occupation postings for a blockchain lead and an advanced cash master. Presently Amazon Web Services (AWS) is searching for a central computerized resources expert that can "assist with driving reception across the worldwide advanced resource local area."AWS Is Looking for a Principal Digital Assets SpecialistOne of the 'Enormous Five' tech organizations, Amazon, has given indications of interest in digital money arrangements and blockchain innovation for a long while presently. For example, on May 26, 2020, the organization licensed a "circulated record accreditation" convention. In February 2021, the online business goliath posted a task posting for a product improvement director to lead a blockchain pilot project situated in Mexico, close by Amazon's "Advanced and Emerging Payments" division.This previous June, the organization's work gateway said Amazon was looking for a blockchain master to make "business use cases across decentralized money (defi)." The next month, it was uncovered Amazon distributed a work commercial for the web based business association's Payments Acceptance and Experience group. At that point, Amazon's posting looked for "an accomplished item pioneer to foster Amazon's computerized money and blockchain procedure and item guide."Presently Amazon Web Services (AWS) is employing a "head advanced resources subject matter expert" in New York to lead the company's fintech group. The work posting was distributed on October 30, and at the hour of composing, there have been 26 candidates up until now. AWS is expecting somebody with at least seven years of fintech business advancement and a person with "openness to appropriated record or blockchain advances.""You will work straightforwardly with a portion of our most essential clients [including] driving worldwide monetary establishments and imaginative fintechs," the AWS advanced resources expert work posting states. "Assisting them with driving change at the most senior levels (CIOs, CDOs, Line of Business pioneers) as they change the manner in which they execute computerized resources (ex. digital currencies, CBDCs, [stablecoins], security-supported tokens, resource upheld tokens, and NFTs) from value disclosure to execution, settlement and guardianship," the posting portrayal adds.While Amazon has been on the chase after advanced money specialists and blockchain tech drives, a huge number of other notable firms have been looking for a similar kind of ability. This month the social news total and conversation site, Reddit distributed an advertisement looking for a senior specialist for a stage that provisions "NFT-supported advanced products."After Reddit's work posting, the computer game retail monster Gamestop distributed a comparative business posting looking for a senior designer for the blockchain NFT stage.

Read More

Nov 05,2021

Defi Losing Track of Its Core Vision as It Gradually Resembles the Very Idea It Aspired to Change

As defi keeps on growing, it chances to accept the very philosophy it at first looked to dismiss as the essential recipients of this new financing worldview are the people who currently own advanced resources.Supplanting Intermediaries Doesn't Directly Improve FinanceWith regards to monetary items and arrangements, nearly everything accompanies a catch, be it outstanding profits from ventures or low financing rates. Decentralized money (defi) is no special case.Defi has acquired enormous notoriety since it looked to eliminate customary money's (tradfi) innate issues and disadvantages. While there is no rejecting that the development of defi has for sure brought admittance obstructions down to monetary arrangements, we can't neglect the awkward reality that defi is becoming, essentially to a degree, as old as, with a 'decentralized' tag.The Blurring Line Between Defi and Tradfi LendingIn the customary framework, any individual who needs to get assets from banks or private loan specialists should outfit their financial assessment. On the off chance that the score meets the models, the credit is supported at a reasonable rate. If the FICO rating is low, the borrower may have to think twice about higher rates. Sometimes, the moneylender may likewise request that the borrower post guarantee for the advance.While defi trades focal specialists with a distributed framework, getting to items like defi loaning expects borrowers to post significant guarantee, frequently higher than the aggregate sum they need to get, brought over-collateralization. Additionally, entering the defi market and utilizing its monetary items requests a comprehension of blockchain innovation and cryptographic forms of money — information moved by a negligible portion of the worldwide populace.Defi loaning at first set off to work with "genuine decentralized loaning" by which anybody needing capital could get an advance with next to no brokers. Sadly, that is not what the present defi loaning takes after. It has viably advanced into one more component for existing computerized resource holders to produce yields by giving what they currently own something to do. The present defi isn't enabling the worldwide unbanked.All things considered, it appears to be that defi is more bank arranged and not quite so comprehensive as publicized. Take, for example, the explanatory development of the defi loaning biological system lately. The main defi loaning stages and conventions have aggregated an all out esteem locked (TVL) of more than $60 billion.AAVE, an open-source and non-custodial loaning and acquiring convention, has nearly $20.96 billion TVL spread across marking and liquidity pools on Avalanche, Ethereum, and Polygon. Similarly, at the hour of composing, Maker DAO brags a TVL $17.06 billion and rising, Compound has a TVL of $11.33 billion, and Instadapp orders generally $12.17 billion TVL, featuring the fleeting development of defi overall.The lines among tradfi and defi are obscuring at a disturbing speed. Here is a model.An entrepreneur from an emerging nation needs financing. Tragically, they don't approach conventional monetary administrations. Some way or another they stumble upon defi loaning and make a record on one of the current stages. At the point when they apply for financing, they understand the guarantee requests will be more than they need to acquire, which clearly they don't have.We should likewise check out the opposite side, the defi loaning stage's point of view. Justifiably, defi loaning stages need guarantee to protect banks' ventures. Yet, does it legitimize the requirement for overcollateralized credits? For the time being, defi isn't bringing unbanked individuals into the framework but instead remunerating favored crypto holders with yield for their current resources.Non-Collateralized Defi Lending: Great in Theory, however Downsides ExistTruly, there aren't any non-collateralized defi loaning stages (none available anywhere), aside from Gluwa, an option monetary framework for the unbanked. Gluwa has collaborated with different global organizations like Aella, Multis, Creditcoin, Jenfi, Wyre, Gopax, and Consensys in developing business sectors. Its combination with Aella's buyer credit application arrived at multiple million clients across Africa. Until now, Gluwa and Aella have worked with in excess of 1,000,000 exchanges, making in excess of 28 million squares all the while.Gluwa doesn't expect clients to post insurance. In any case, there's a trick. The financing cost on these non-collateralized credits is a lot higher than the typical collateralized defi advances accessible from AAVE, Compound, and comparable stages.Accordingly, Gluwa, albeit a defi arrangement, shares numerous comparable qualities with the customary loaning getting worldview, similar to private non-collateralized loaning where the bank faces high danger challenges and passes along this danger as higher financing costs.The Way ForwardBetween over-collateralized defi advances and exorbitant interest non-collateralized ones, there's a ton to consider. While stages request security, they for sure make it simple for anybody to get to capital with the snap of a button. However at that point once more, just for individuals who currently own computerized resources. It refutes the possibility of inclusivity and equivalent freedom for all — basically the establishments of defi. The opposite side of the defi coin is that non-collateralized credits charge higher financing costs to adjust the danger, which again overcomes defi's vision of reasonable and defended procuring for all.A really decentralized loaning and getting process need to adjust the danger and return similarly for the two moneylenders and borrowers, which is hard to accomplish. Along these lines, later on, we might observe a superior variant of decentralized loaning, or we might wind up with "genuinely" decentralized loaning, that flawlessly looks like the conventional monetary market, consequently completing the cycle and turning into the very thing it once needed to change.

Read More

Nov 04,2021

Burger King Giving Away Bitcoin Ether Dogecoin in Partnership With Robinhood

Burger King is parting with 20 bitcoin, 200 ether, and 2,000,000 dogecoin this month in organization with exchanging stage Robinhood. "Every participant might get up to 21 Prize Codes" that can be recovered for digital forms of money on Robinhood.'Burger King With a Side of Crypto'Drive-thru eatery chain Burger King has reported "Burger King with a side of crypto," its freshest proposal for Royal Perks individuals.To be qualified to take an interest, clients must "make a base $5.00 pre-charge Burger King ('BK') food as well as drink buy" either online at BK.com, utilizing the BK application, or at partaking BK cafés, the organization clarified, adding:The prize pool incorporates 2,000,000 dogecoin, 200 ethereum and 20 bitcoin, so just 220 visitors could get a bitcoin or ethereum digital currency prize."There will be 2,000,220 Prize Codes accessible as of the beginning of the advancement," Burger King further definite. Members should be Royal Perks individuals, for which join is free.As indicated by the organization's gauges, the "chances of winning each prize toward the beginning are roughly: Bitcoin Prize: 1:100,011 (20 accessible); Ethereum Prize: 1:10,001 (200 accessible) and Dogecoin Prize: 1:1 (2 million accessible)." However, the "Chances will change as prizes are circulated," and "Unclaimed Prizes won't be granted," the cheap food organization added.Clients will get an email from Burger King soon after making a passing buy that incorporates a prize code. There is a restriction of one prize code for every individual each day.The Burger King crypto advancement has two stages. The first is the "Prize Code Receipt" stage; the second is the "Prize Claim" stage. The two stages started on Nov. 1 at 10:00 a.m. EST. The principal stage will end on Nov. 21 at 11:59 p.m. EST and the second stage on Dec. 17 at 11:59 p.m. EST.Members have until the finish of the subsequent stage to guarantee their prize codes through Robinhood. "You should open a Robinhood Crypto account and download the Robinhood application to guarantee your digital money prize," Burger King noted.The cheap food chain explained:When all Prize Codes have been disseminated, the Prize Code Receipt Phase will end, regardless of whether this is before November 21, 2021. Every participant might get up to 21 Prize Codes.The authority Burger King crypto advancement rules can be seen as here.

Read More

Nov 03,2021

Spending a String of 20000 BTC 2 Bitcoin Whale Transactions Move Over Dollar 1.2 Billion

On November 1, at block stature 707,639, a blockchain parser got two bitcoin whale moves that moved around 19,876 bitcoin worth $1.2 billion in the blend of 2,819 exchanges. Strangely, the proprietor utilized a comparable parting component the old fashioned mining whale blockchain parsers got, spending strings of 20 square awards all through 2020 and 2021.Bitcoin Whale WatchingBitcoin whales are puzzling creatures in light of the fact that in a blockchain universe of pseudonymity we possibly see them when they move. Last year and this year too, Bitcoin.com News has pursued a particular whale element that burned through a large number of bitcoin mined in 2010.Each and every time the whale went through the decade-old bitcoin that sat inactive the entire time, the substance spent precisely 20 square rewards or 1,000 BTC. After the exchange, the wallets holding 1,000 BTC scattered the assets into more modest estimated wallets.As per the maker of btcparser.com, the near 20K BTC moved at block tallness 707,639 on November 1 had comparative dividing mechanics with the "20×50 renewals." The blockchain parser's proprietor would figure that the element spending the two exchanges could be a similar individual or association.The exceptional exchanges originating from block tallness 707,639 got from the bitcoin addresses "15kEr" and "1PfaY." The 15kEr location moved 9,900.87 BTC, while 1PfaY burned through 9,975.31 BTC.One of the bitcoin addresses' dividing techniques (imagined left) and the blockchain adventurer information recording the 19,876 bitcoin continued on Monday (envisioned right).The two exchanges were sifted among 2,819 BTC moves with 6,406 data sources recorded in block 707,639. The yield absolute in that square was 9,587 with 78,704.53 BTC scattered. The two exchanges originating from 15kEr and 1PfaY, addressed over 25% of the BTC handled in block 707,639.After the assets were sent, the almost 20K BTC was parted into 200 wallets with 100 BTC each. Then, at that point, the bitcoin whale's assets were parted again into a lot more modest wallets until they at last solidified into various sums.The 2 Transactions Leveraged Moderate Privacy Tactics — 50 Bitcoin Block Reward From 2011 Spent 59 Blocks LaterInformation from blockchair.com's Privacy-o-meter for Bitcoin Transactions device shows the wallet that sent the 9,975.31 BTC got a score of 60 or "moderate." This is on the grounds that coordinated with addresses were recognized and blockchair.com's device takes note of that "coordinating essentially lessens the obscurity of addresses." The 9,900.87 BTC spend experiences similar following weaknesses as coordinated with addresses were additionally distinguished.Close by the near 20K BTC move in two separate exchanges, 59 squares later 50 resting bitcoins that had sat inactive since April 28, 2011, were moved at block tallness 707,698. The 50 BTC sat inactive for more than a long time since the day they were mined and when they were moved, the conversion scale for the square award of 50 BTC was simply more than $3 million.Blockchair.com's protection instrument shows the exchange got a score of 0 or "basic." A basic score implies that the device "distinguished issues [that] essentially jeopardize the security of the gatherings in question."

Read More

Nov 02,2021

Goldman Sachs Predicts Ethereum Could Hit Dollar 8000 This Year

Worldwide speculation bank Goldman Sachs is apparently foreseeing that the cost of ether could ascend to $8,000 by year-end. The bank's examiners clarified that cryptographic forms of money have exchanged line with swelling breakevens starting around 2019.Ether Could Reach $8K by Year-End, According to Goldman SachsGoldman Sachs has purportedly clarified in an examination note coursed by the bank's overseeing head of Global Markets, Bernhard Rzymelka, that the cost of ether (ETH) could hit $8,000 by year-end. The note subtleties that cryptographic forms of money have exchanged line with swelling breakevens beginning around 2019, as per Zerohedge.Referring to a diagram showing the Bloomberg Galaxy Crypto Index (red) on a log pivot and the USD 2-year forward 2-year swelling trade (blue), Goldman's experts noticed that "the nearby background looks strong for ethereum."The examiners added: "It has followed swelling markets especially intently, reasonable mirroring the favorable to repeating nature as 'network based' resource. Furthermore, the latest spike in expansion breakevens recommends potential gain hazard if the main relationship of late scenes was to hold (dim circles)." They further brought up:This lines up well with the ethereum diagram.The Goldman note further depicts: "The market has begun to press against the unequaled high with a restricting wedge: Either an indication of weariness and topping … or a beginning stage of a speeding up assembly upon a break higher." The investigator likewise noticed that "the RSI presently can't seem to hit the overbought levels seen in past market highs."Assuming the chronicled relationship with swelling advances endures, the cost of ethereum could flood as high as $8,000 in the following two months, the distribution passed on.Goldman's ETH value conjecture is higher than a new expectation by Finder.com's board of 50 fintech subject matter experts. The value correlation entryway refreshed the board's ethereum value forecast last week, showing its specialists anticipating that ETH should hit $5,114 by year-end, $15,364 by 2025, and $50,788 by 2030.The cost of ETH is $4,324.98 and its market cap is $511.16 billion at the hour of composing, in view of information from Bitcoin.com Markets. Ether hit an untouched high on Oct. 28. It has climbed 5.5% in the beyond seven days and 30.7% over the most recent 30 days.The worldwide venture bank officially settled a crypto exchanging group in May and dispatched bitcoin subsidiaries exchanging that very month. In June, the bank's head of advanced resources, Mathew McDermott, uncovered that Goldman Sachs plans to offer prospects and choices exchanging ETH before very long.In July, the bank's experts said ether looked "like the cryptographic money with the most noteworthy genuine utilize potential as Ethereum, the stage on which it is the local advanced cash, is the most famous improvement stage for shrewd agreement applications."

Read More

Nov 01,2021

South African Finance Minister Seeks to Stop Pension Funds From Investing in Cryptocurrencies

South African money serve Enoch Godongwana has an advanced proposition that bar annuity assets from putting resources into digital currencies, and has likewise set November 12 as the public remark cutoff time.Digital currencies a Gray AreaAs indicated by a report by Business Insider SA, Godongwana's time period for people, in general, to remark on the draft proposition recommends he needs the progressions to become effective before the year's end.Before Godongwana's proposition, South African annuity finances thought about digital forms of money as a hazy situation where speculation of up to 2.5% of resources held was allowable. Be that as it may, as the Business Insider clarifies, this questionable piece of guidelines utilized by benefits assets to lawfully put resources into digital currencies will be eliminated once the clergyman's proposed changes get the endorsement."An [pension] asset may not put resources into crypto-resources straightforwardly or in a roundabout way," the report clarified, citing new standards distributed in an administration archive.In the interim, the money service's draft proposition recommends Godongwana is additionally looking to grow the meaning of digital forms of money to incorporate subordinates, for example, non-fungible tokens (NFTs) just as any computerized resource not given by national banks. In the report, Godongwana's proposed meaning of digital forms of money read:'[C]rypto-resource' signifies a computerized portrayal of significant worth that isn't given by a national bank, yet is equipped for being exchanged, moved, or put away electronically by normal and lawful people with the end goal of installment, venture, and different types of utility; applies cryptographic strategies and utilizations appropriated record innovation.South African Regulators Working to Find Right FrameworkAs the report takes note of, Godongwana's assurance to prevent benefits assets from putting resources into cryptographic forms of money comes as South African controllers are endeavoring to track down the suitable system to administer the blockchain business. For example, in June 2021, South Africa's Intergovernmental Fintech Working Group (IFWG) delivered its new position paper requiring the guideline of the country's digital money environment.Also, Bitcoin.com News revealed in July that the South African Revenue Services had made changes to its internet-based assessment documenting framework in a move that designated digital money exchange merchants.Very much like other South African controllers that have utilized purchaser security contemplations to legitimize their activities against cryptographic forms of money, Godongwana's service likewise utilizes comparable contentions to help the draft recommendations. It declares the proposed changes will guarantee security by restricting the degree to which retirement assets might put resources into a specific resource or specific resource classes.

Read More

Oct 30,2021

Ethereum Captures New All Time Price High ETH Market Cap Surpasses $510 Billion

Nine days prior, bitcoin arrived at another untouched high (ATH) and presently the second driving crypto resource ethereum has tapped an ATH on Friday morning. Ethereum arrived at a high of $4,416 per unit and has since withdrawn around 2% down from that value position.Ethereum Reaches New All-Time Price HighThe second-biggest crypto market capitalization has a place with ethereum (ETH) with a valuation of around $510 billion today.As of now, there is $28.9 billion devoted to ether exchanges and ETH's market cap has a strength rating of around 18.8%.ETH arrived at its untouched high during the early daytime exchanging meetings on October 29, tapping a high of $4,416 per ETH.Year-to-date, ethereum (ETH) has acquired 1,013% and during the most recent 30 days, the crypto resource has expanded by 54.7%.The stable coin tie (USDT) is the top pair exchanging with ethereum (ETH) on Friday directing 43.53% of all exchanges. This is trailed by USD (20.65%), BTC (9.75%), BUSD (7.90%), EUR (4.03%), and KRW (3.34%).Binance is the most dynamic trade exchanging ethereum today with 24.94% of all ETH's exchanging action. Binance is trailed by crypto exchanging stages like Lbank, Coinbase, FTX, Yobit, and Huobi Pro.The cost of ethereum is a lot higher than the crypto resource's unsurpassed high from 2017, as the cost is 8,985.15% higher from that point forward.Ethereum's hash rate is approximately 725 terahash each second (TH/s) and there's around 3.6% of Ethereum hash on the stage Nicehash.The profit from venture (ROI) on ethereum (ETH) since the day it was presented is 9,364.4% today, if an individual participated in the beginning deal.

Read More

Oct 29,2021

AMC Theatres Considers Accepting Shiba Inu Alongside Dogecoin as SHIB Popularity Soars

The CEO of the world's greatest film show association, AMC Entertainment, is seeing whether his association should recognize shiba inu (SHIB) for portions. The association is presently meaning to recognize a couple of cryptographic types of cash by year-end, including dogecoin.President Asks Whether AMC Should Accept Shiba InuThe CEO of AMC Entertainment, Adam Aron, set up a review on Twitter Friday seeing whether his association should recognize portions in shiba inu (SHIB).AMC is the greatest film show association in the U.S., Europe, and the world. As of March 31, the association asserted or worked around 950 theaters and 10,500 screens around the world.Aron expressed: "As you presumably know, you would now have the option to purchase AMC present vouchers using cryptographic cash, and our IT pack is forming code so that soon we can recognize online portions in bitcoin, ethereum, litecoin, and dogecoin among others. Would it be a smart thought for us to attempt to take shiba inu too?"At the hour of making, 44,659 votes have adequately been counted at this point the study really has five days left. Up until this point, 89.2% are strong of the film chain enduring SHIB.This is Aron's second review on Twitter, according to his tweet. The head, coordinated in September, was concerning whether AMC Theaters should recognize rival picture crypto dogecoin (DOGE). Aron tweeted after the vote based wrapped up: "So Fascinating! Dogecoin Poll was by far my most raised ever-gotten tweet. In 24 hours, 4.2 million viewpoints, my most ever retweets, most anytime replies. 140,000 votes 77% yes 23% no."The AMC CEO said in September that his scene chain will recognize bitcoin, ethereum, litecoin, and bitcoin cash "for online ticket and concession portions by year-end 2021."As of late, he detailed: "As we work to recognize online crypto portions, as of now you can buy AMC Theaters automated present vouchers (up to $200 every day) with dogecoin and other advanced cash using a Bitpay Wallet. Recognized on our site, compact application, and in theaters."

Read More

Oct 28,2021

Elon Musk Reveals Real Reason He Supports Dogecoin Says Many People at Tesla and Spacex Own DOGE

Elon Musk has uncovered the genuine explanation he upholds the image of digital currency dogecoin. He shared that many individuals he converses with at his organizations, Tesla and Spacex, own dogecoin, noticing that "it seemed like individuals' crypto."Heaps of People Elon Musk Talks to at Spacex and Tesla Own DogecoinTesla and Spacex CEO Elon Musk uncovered Sunday the genuine explanation he started supporting dogecoin. He noticed that many individuals he converses with at the two organizations own the image of digital currency.Reacting to a tweet by dogecoin holder Glauber Contessoto, who said the interest for DOGE is genuine, referring to a study that found with regards to 33% of U.S. crypto holders own the image cryptographic money, Musk composed:Loads of individuals I conversed with on the creation lines at Tesla or building rockets at Spacex own Doge. They aren't monetary specialists or Silicon Valley technologists. That is the reason I chose to help Doge — it seemed like individuals' crypto.The Doge people group invites Musk's remark and backing. "A large portion of us don't come from special foundations and genuinely can't identify with the specialists in Silicon Valley," Contessoto reacted. "We simply need to have confidence in crypto that addresses us all. Dogecoin is the little man represented in crypto which is the reason we love it. We like your help, Elon."A review by value correlation entry Finder shows that more individuals in the U.S. own dogecoin than in some other country. The review states:Dogecoin sees its most elevated reception in the United States with 30.6% of crypto proprietors saying they own dogecoin. This is 1.6 occasions the worldwide normal reception pace of 19.2%.At the hour of composing, the cost of dogecoin is up 11.31% over the previous week, with DOGE sitting at $0.2664 dependent on information from Bitcoin.com Markets.Musk recently said he by and by claims three digital currencies: bitcoin, ether, and dogecoin. On Sunday, he tweeted a few significant dogecoin upgrades and affirmed that he doesn't claim any shiba inu tokens. In August, the Tesla manager concurred with the Shark Tank star Mark Cuban that dogecoin is the "most grounded" crypto for installments.

Read More

Oct 27,2021

Finders Panel of Fintech Experts Predict Ethereum Will Reach $5114 This Year Over $50K by 2030

Toward the finish of July, the item examination site Finder.com distributed its exploration discoveries from a board of specialists that anticipated the crypto resource ethereum would arrive at $4.5K this year. On October 25, Finder refreshed its "Ethereum Price Predictions Report" that surveyed 50 monetary innovation trained professionals and ethereum is currently expected to reach "$5,114 before the current year's over."Locater's Panel Suggests Ethereum Will Be Over $5K by the end of the yearLocater, a contributing sidekick application and item correlation site, has distributed various overviews and board gauges concerning the developing cryptographic money economy. The examination site's analysts dive into a wide range of crypto resources like bitcoin (BTC), litecoin (LTC), and ethereum (ETH). Last July, Finder's scientists surveyed specialists in the monetary innovation (fintech) area and the gathering anticipated that ether would arrive at $4.5K continuously's end and $18,000 constantly 2025.On Monday, Finder.com's Tim Falk and Richard Laycock distributed a new report that surveyed 50 fintech experts who talked about the second-biggest crypto-resource, ethereum (ETH). During the most recent 24 hours, ETH spot costs have been floating simply over the $4K territory — somewhere in the range of $4,075 and $4,250 per unit. In the most recent report, 50 fintech experts were surveyed from September 24 to October 11, 2021. Locater said that the scientists utilized the overview in a "shortened mean," which implies the top and base 10% exceptions were eliminated from the information.The report shows that while ETH is relied upon to reach $5,114 before the current year's over, by 2025, the board predicts ETH's cost will leap to $15,364 per unit. Specialists additionally accept that a solitary ether can then more than triple before the finish of 2030, coming to $50,788 per ETH. The information takes that 63% of specialists believe it's for a ride to purchase ether, while 9% say sell. 28% of the board individuals surveyed say that ether holders ought to "hodl."Ethereum Expected to Lose 30% of Market Share to Alternative L1 Networks, 13% of Panelists Believe Solana Can Overtake EthereumAnother fascinating measurement noted is that ethereum (ETH) is relied upon to lose 30% of its portion of the overall industry to elective layer-1 (L1) networks throughout the following year. Daniel Polotsky, the author of Coinflip, feels that before the year's over ETH will be esteemed at $4,500. Notwithstanding, Polotsky believes Ethereum's development might outperform the main crypto resource bitcoin (BTC) sometime in the not so distant future."Ethereum makes a superior showing of supporting improvement on its blockchain and will have a more lightweight evidence of-stake mining model than Bitcoin [which] implies that it might possibly be the foundation of Web 3.0," Polotsky commented in the study's notes. He added:[This] persuades me to think that its pace of development might even outperform that of bitcoin throughout the following decade.The information additionally shows that one out of ten of Finder's ethereum study specialists (13%) accept the Solana (SOL) organization will overwhelm Ethereum as the essential decentralized money (defi) stage. Johannes Schweifer, CEO of Coreledger AG, is an individual from the 13% that trusts SOL can beat ETH as such. As per Schweifer, Ethereum will not have the option to address the organization's scaling issues."It was not worked for high throughput, and engineers realize that, while other layer-1 arrangements, for example, Solana are. The market will extend quickly with their development and they will get the vast majority of all new business that isn't only founded on hypothesis," Schweifer added.

Read More

Oct 26,2021

Mastercard to Enable Merchants on Its Network to Offer Crypto Products and Services

Installments goliath Mastercard has banded together with a digital currency trade to permit its accomplices and dealers in the U.S. to offer crypto arrangements, including the purchasing, selling, and holding of digital forms of money. "We need to offer every one of our accomplices the capacity to all the more effectively add crypto administrations to whatever it is they're doing."Mastercard's Network Integrates CryptoMastercard (NYSE: MA) and digital currency trade stage Bakkt (NYSE: BKKT) declared "a multi-layered organization" Monday at the Money20/20 occasion.The association points "to make it simpler for shoppers, banks, and fintech in the U.S. to embrace and offer an expansive arrangement of digital money arrangements and administrations," the declaration subtleties. "Bakkt expands Mastercard's biological system of cryptographic money accomplices empowering crypto-as-a-administration, which gives fast admittance to digital currency abilities."The two organizations clarified:Mastercard accomplices will actually want to offer digital money arrangements. These incorporate the capacity for buyers to purchase, sell and hold computerized resources through custodial wallets fueled by the Bakkt stage and smoothed out issuance of marked crypto charges and Mastercards.The installments monster has associations with in excess of 20,000 monetary foundations around the world, and there are 2.8 billion Mastercards being used, as per the organization. An October 2019 Nilson Report expresses that Visa and Mastercard both had 52.9 million traders — more than some other organization around the world.Mastercard further uncovered that crypto will likewise be coordinated into its dedication arrangements, permitting its accomplices to "offer cryptographic money as remunerations and make fungibility between devotion focuses and other computerized resources." The declaration adds:This implies that buyers can procure and spend awards in digital money rather than conventional devotion focuses and consistently convert their crypto possessions to pay for buys.Sherri Haymond, Mastercard's leader VP of advanced organizations, was cited as saying: "We need to offer every one of our accomplices the capacity to all the more effectively add crypto administrations to whatever it is they're doing. Our accomplices, be they banks, fintech, or shippers can offer their clients the capacity to purchase, sell and hold digital money through incorporation with the Bakkt stage."Bakkt CEO Gavin Michael thought: "We're bringing the hindrances down to the section, permitting individuals to take something like your prize's focuses and exchange them into crypto. It's a simple way of getting moving in light of the fact that you're not utilizing cash, you're putting something an inactive resource sitting on your asset report, and we're permitting you to give it something to do."

Read More

Oct 25,2021

Analyst Suggests Bitcoin's Bottom Could Be $50K Assuming BTC Surpasses $200K This Cycle

The cost of bitcoin in October has given indications of a twofold air pocket like the bull run in 2013, and examiners have been attempting to figure the main crypto resource's top. On October 20, digital money market investigator Justin Bennett talked about bitcoin's conceivable value floor after it arrives at the top. Bennett recommends the finish of this cycle could be somewhere in the range of $207,000 and $270,000. Accepting bitcoin crosses $200K per coin, Bennett thinks the advanced resource's base after a 80% pullback will be around $50K.'2013 Vibes,' 'End-of-Cycle Targets,' and Searching for the Elusive BottomThe cost of bitcoin (BTC) arrived at an untouched high (ATH) at $67,017 on October 20, 2021, and from that point forward the cost has shed around 8% in esteem. On that very day, digital currency market examiner Justin Bennett distributed a few experiences about bitcoin's future in a blog entry called "Graphing Bitcoin's Next Five Years."Cryptocademy's examiner Bennett talks about BTC's market basics and he offers a forecast of the finish of the cycle too. As of late, numerous bitcoin allies presume that a 2013-like twofold air pocket is not too far off, and the scandalous stock-to-stream maker Plan B clarified on Saturday that he's inclination "2013 energies."The blog entry composed by Bennett covers bitcoin bull cycles and discusses where bitcoin (BTC) is going over the course of the following five years. "A glance at the 2.272 and 2.414 Fibonacci augmentations from the last two cycles shows an objective region that was arrived at the twice," Bennett composes."On the off chance that we apply that equivalent region to the current tirade, we get a finish of-cycle focus for Bitcoin somewhere in the range of $207,000 and $270,000," the investigator adds. Following the end cycle standpoint, Bennett subtleties that the last three bear showcases that followed the bull cycles have "delivered redresses of 94%, 87%, and 84% separately."Bennett composes that the past information likewise shows that each bear market was less agonizing than the one earlier. The expert features that this information demonstrates that the main crypto resource bitcoin (BTC) is turning into a "developing business sector."As BTC keeps on developing, Bennett stresses, bitcoin is "prone to see consistent losses and bear market revisions." The Cryptocademy expert accepts this end cycle will be the same. "Thusly, I'd anticipate that the next bear market should pullback somewhere in the range of 75% and 80% from the pinnacle," Bennett subtleties. The computerized money market examiner's blog entry adds:On the off chance that we accept bitcoin comes to $200,000+ this cycle and pulls back somewhere in the range of 75% and 80% during the following bear market, it would put the following cycle low somewhere near $50,000. Also, that bodes well. $50,000 is a brain research number, and it's extremely close the $65,000 high that went on for a considerable length of time as of late.Foreseeing the Lowest of LowsBennett's forecast follows the new bitcoin value model created by Will Clemente. The lead bits of knowledge expert at Blockware Solutions, Will Clemente, tweeted about a new bitcoin value model called the "Illiquid Supply Floor" in mid-September. "Presenting: 'Illiquid Supply Floor,'" Clemente tweeted on September 15. "This consolidates Glassnode's illiquid supply information with Plan B's conventional S2F model, making a value floor dependent on Bitcoin's continuous shortage. As of now $39K," he added at that point.There have been various individuals endeavoring to call bitcoin's value top and some even accept a solitary "bitcoin will ultimately be comparable to $1 million." Bennett's and Clemente's new assertions address bitcoin's value base and the most reduced of lows. Both of these forecasts consolidated demonstrate that the least of lows following this bull cycle's top could be anyplace between $39K to $50K.

Read More

Oct 22,2021

Real Estate Platform Pacaso Accepts Crypto Assets for Payments CEO Says Mass Crypto Adoption Well Underway

On October 20, the day bitcoin crushed another unsurpassed value high, the land stage Pacaso reported it will be tolerating digital forms of money through Bitpay. The CEO of the land firm that assists individuals with purchasing and co-own a subsequent home, Austin Allison, says the firm has seen expanded crypto reception "across the land business."Land Platform Pacaso Now Supports Crypto PaymentsThe firm Pacaso is a land stage helped to establish by Spencer Rascoff and Austin Allison. Rascoff is notable for helping to establish Zillow Group and helping to establish Hotwire.com also. In October 2020, Rascoff helped to establish Pacaso with Allison, and the organization is viewed as a land stage that makes possessing a second home simpler by utilizing shared proprietorship. Pacaso's plan of action is like the co-op model but at the same time, it's a touch unique.Disregard townhouses, with Pacaso, you own a home, in addition to a square of time," the organization's site subtleties. "You can book stays consistently, not every year. Furthermore, resale? It's quick and smoothed out, and you set the value." Now the firm has chosen to acknowledge crypto resources by means of the Atlanta-based computerized money installment stage Bitpay."Advanced monetary standards and the blockchains that power them are seeing expanded reception across the land business, and a crypto installment choice is a common subject in our discussions with forthcoming purchasers of second homes," said Austin Allison, Pacaso's fellow benefactor, and CEO. "As we grow universally and put second-home co-possession accessible for additional individuals across the globe, we're excited to have the option to react to that request and stretch out however many installment choices as we can to our clients."Bitpay CEO Is Seeing More Crypto Transactions Being Made for 'Enormous Purchases Like Real Estate'The declaration itemized that Pacaso clients will actually want to look over a bunch of advanced resources like bitcoin (BTC), ethereum (ETH), litecoin (LTC), bitcoin cash (BCH), dogecoin (DOGE), and wrapped bitcoin (WBTC). Close by this, Pacaso customers can use five unique stablecoins also. Stephen Pair, CEO of Bitpay said lately the organization has seen a lot bigger exchanges, for example, individuals purchasing homes."We are seeing more exchanges being made for enormous buys like land as more crypto holders need to go through and experience their time on earth on crypto. Pacaso makes a second home a reality," Pair clarified on Wednesday. "The market potential for crypto is gigantic, with $55 billion as the assessed worth of buys customers will make utilizing cryptographic money in the following a year."Pacaso says that paying with crypto will be similarly pretty much as simple as it would utilizing fiat, as customers can use their crypto resources for use as an "initial investment in their home, and money the rest of the exchange, or in any case split installment among crypto and fiat cash." Pacaso's CEO sees mass reception of crypto is "well in progress" and with that homebuyers will need to use an assortment of installment choices."Regardless of whether you're HODLing Bitcoin, expanding out of a DOGE-substantial portfolio, or someplace in the middle, Pacaso is here to assist you with understanding your second-home dreams," Allison closed.

Read More

Oct 21,2021

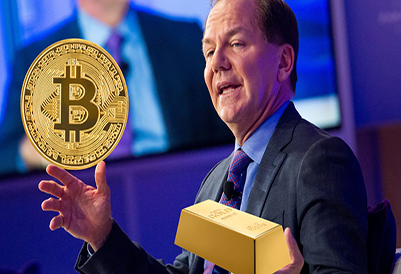

Billionaire Paul Tudor Jones Now Prefers Crypto Over Gold as Inflation Hedge

Very rich person speculative stock investments director Paul Tudor Jones says that bitcoin is as of now "dominating the race against gold." He added that digital currency is his favored expansion fence over gold.Paul Tudor Jones Chooses Bitcoin Over GoldPaul Tudor Jones, the originator of resource the executives firm Tudor Investment Corp., discussed bitcoin being his favored fence against expansion in a meeting with CNBC Wednesday. He said:Obviously, there's a spot for crypto. Obviously, it's triumphant the race against gold right now … It would be my favored one over gold right now."I have crypto in single digits in my portfolio," he proceeded. "I do think we are moving into an inexorably digitized world."Jones said he is stressed over rising swelling, noticing that it's representing a significant danger to the U.S. monetary business sectors and the recuperating Covid-hit economy.The cost of bitcoin outperformed unequaled highs Wednesday after the first bitcoin prospects trade exchanged asset (ETF) in the U.S. began exchanging on the NYSE. Gold lost 8% in the course of recent months while bitcoin acquired 437%.The very rich person financial backer was approached to remark on putting resources into a bitcoin ETF as a way of getting openness to the digital money. Conceding that he isn't "a genuine master on ETFs," Jones said:I figure a superior way of getting in is really own the physical bitcoin, to set aside the effort to figure out how to claim it … I figure the ETF would be fine. I think the way that it is SEC-supported should give you incredible solace.He was likewise inquired as to whether the endorsement of an ETF implies that the controllers are saying that crypto is digging in for the long haul. Jones answered:I think crypto is setting down deep roots.He continued to clarify the explanation the U.S. is "the most noticeable monetary force on the planet is on the grounds that we release our singular entrepreneurism and innovativeness."Interestingly, he said, "China is doing the specific inverse. That spot is on a monetarily sluggish boat toward the south pole."The tycoon reserve chief recently said that bitcoin was a store of riches, similar to gold. He started suggesting BTC for portfolios early last year. In October 2020, he said that he saw a huge potential gain in bitcoin and compared putting resources into the digital money to putting resources into early Apple or Google.

Read More

Oct 21,2021

Hindu Paramilitary Group Calls on Indian Government to Regulate Cryptocurrencies