Latest News

A report of a current event, knowledge, information

Defi Losing Track of Its Core Vision as It Gradually Resembles the Very Idea It Aspired to Change

As defi keeps on growing, it chances to accept the very philosophy it at first looked to dismiss as the essential recipients of this new financing worldview are the people who currently own advanced resources.

Supplanting Intermediaries Doesn't Directly Improve Finance

With regards to monetary items and arrangements, nearly everything accompanies a catch, be it outstanding profits from ventures or low financing rates. Decentralized money (defi) is no special case.

Defi has acquired enormous notoriety since it looked to eliminate customary money's (tradfi) innate issues and disadvantages. While there is no rejecting that the development of defi has for sure brought admittance obstructions down to monetary arrangements, we can't neglect the awkward reality that defi is becoming, essentially to a degree, as old as, with a 'decentralized' tag.

The Blurring Line Between Defi and Tradfi Lending

In the customary framework, any individual who needs to get assets from banks or private loan specialists should outfit their financial assessment. On the off chance that the score meets the models, the credit is supported at a reasonable rate. If the FICO rating is low, the borrower may have to think twice about higher rates. Sometimes, the moneylender may likewise request that the borrower post guarantee for the advance.

While defi trades focal specialists with a distributed framework, getting to items like defi loaning expects borrowers to post significant guarantee, frequently higher than the aggregate sum they need to get, brought over-collateralization. Additionally, entering the defi market and utilizing its monetary items requests a comprehension of blockchain innovation and cryptographic forms of money — information moved by a negligible portion of the worldwide populace.

Defi loaning at first set off to work with "genuine decentralized loaning" by which anybody needing capital could get an advance with next to no brokers. Sadly, that is not what the present defi loaning takes after. It has viably advanced into one more component for existing computerized resource holders to produce yields by giving what they currently own something to do. The present defi isn't enabling the worldwide unbanked.

All things considered, it appears to be that defi is more bank arranged and not quite so comprehensive as publicized. Take, for example, the explanatory development of the defi loaning biological system lately. The main defi loaning stages and conventions have aggregated an all out esteem locked (TVL) of more than $60 billion.

AAVE, an open-source and non-custodial loaning and acquiring convention, has nearly $20.96 billion TVL spread across marking and liquidity pools on Avalanche, Ethereum, and Polygon. Similarly, at the hour of composing, Maker DAO brags a TVL $17.06 billion and rising, Compound has a TVL of $11.33 billion, and Instadapp orders generally $12.17 billion TVL, featuring the fleeting development of defi overall.

The lines among tradfi and defi are obscuring at a disturbing speed. Here is a model.

An entrepreneur from an emerging nation needs financing. Tragically, they don't approach conventional monetary administrations. Some way or another they stumble upon defi loaning and make a record on one of the current stages. At the point when they apply for financing, they understand the guarantee requests will be more than they need to acquire, which clearly they don't have.

We should likewise check out the opposite side, the defi loaning stage's point of view. Justifiably, defi loaning stages need guarantee to protect banks' ventures. Yet, does it legitimize the requirement for overcollateralized credits? For the time being, defi isn't bringing unbanked individuals into the framework but instead remunerating favored crypto holders with yield for their current resources.

Non-Collateralized Defi Lending: Great in Theory, however Downsides Exist

Truly, there aren't any non-collateralized defi loaning stages (none available anywhere), aside from Gluwa, an option monetary framework for the unbanked. Gluwa has collaborated with different global organizations like Aella, Multis, Creditcoin, Jenfi, Wyre, Gopax, and Consensys in developing business sectors. Its combination with Aella's buyer credit application arrived at multiple million clients across Africa. Until now, Gluwa and Aella have worked with in excess of 1,000,000 exchanges, making in excess of 28 million squares all the while.

Gluwa doesn't expect clients to post insurance. In any case, there's a trick. The financing cost on these non-collateralized credits is a lot higher than the typical collateralized defi advances accessible from AAVE, Compound, and comparable stages.

Accordingly, Gluwa, albeit a defi arrangement, shares numerous comparable qualities with the customary loaning getting worldview, similar to private non-collateralized loaning where the bank faces high danger challenges and passes along this danger as higher financing costs.

The Way Forward

Between over-collateralized defi advances and exorbitant interest non-collateralized ones, there's a ton to consider. While stages request security, they for sure make it simple for anybody to get to capital with the snap of a button. However at that point once more, just for individuals who currently own computerized resources. It refutes the possibility of inclusivity and equivalent freedom for all — basically the establishments of defi. The opposite side of the defi coin is that non-collateralized credits charge higher financing costs to adjust the danger, which again overcomes defi's vision of reasonable and defended procuring for all.

A really decentralized loaning and getting process need to adjust the danger and return similarly for the two moneylenders and borrowers, which is hard to accomplish. Along these lines, later on, we might observe a superior variant of decentralized loaning, or we might wind up with "genuinely" decentralized loaning, that flawlessly looks like the conventional monetary market, consequently completing the cycle and turning into the very thing it once needed to change.

Related News

Bitcoin becoming less-risky as an investment, Novogratz says

Brazil is prepping an IPO for its state-run digital bank

Indian bank to offer crypto services across its 34 branches

The blockchain revolution is already here, say Alex and Don Tapscott

‘The cryptoruble is the future’ says Russian policymaker

Bitcoin’s Price Must Pass $40K to Halt Exodus of Traders:

Cape Cod's Largest Hospital Gets Bitcoin Donations Worth $800K

Spain May Soon Regulate “Risky†Bitcoin Street Ads

Brazil Approves First Latam Based Ethereum ETF

Google's New Cryptocurrency Ad Policy Goes Into Effect

Second Largest U.S. Mortgage Lender to Take Bitcoin Payments

Central Bank of Brazil Researches Creation of Digital Real

14 Suspects in Cryptocurrency Investment Scam Arrested in Taiwan

India Central Bank RBI Still Has Serious Concerns About Cryptocurrency

UK Post Office Adds Option to Buy Bitcoin via Easyid App

Bank of Russia Lists Crypto Companies Among Financial Pyramids

Major Cryptocurrency Exchanges Explore Entering Indian Crypto Market

Thailand to Develop Cryptourism Considers Issuing Utility Token

Grayscale Confirms Plan to Convert GBTC Into Bitcoin ETF

Goldman Sachs Predicts Ethereum Could Hit Dollar 8000 This Year

Indiana Star Bank Launches Bitcoin Trading Services

Venezuelan Court Rolls Back Seizure of More Than 1000 Bitcoin Miners

Bitcoin Dominance Slides Below 40 Percent for First Time in 6 Months

Leading Supermarket Chain in Croatia Introduces Crypto Payments

ECB Paper Marks Success Factors for CBDCs Digital Euro

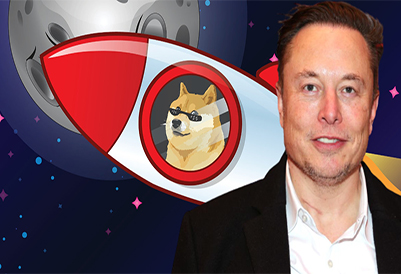

Dogecoin Soars After Elon Musk Announces Tesla Will Accept DOGE

Leading Supermarket Chain in Croatia Introduces Crypto Payments

Chinas Xinhua News Agency to Issue NFTs Despite Crackdown on Crypto

Former Finance Secretary Doubts Indian Government Understands Crypto

Indian Authorities Raid Cryptocurrency Exchanges for Tax Evasion

Crypto Tops Investor Threats for US Securities Regulators

New Spanish Regulations to Target Crypto Investment Ads

Crypto Users and Exchanges Must Now Report Transactions in Colombia

Colombia Registers First Real Estate Purchase With Bitcoin

Indian Parliament Member Clarifies Legal Status of Cryptocurrency

Wells Fargo Cryptocurrency Has Entered Hyper Adoption Phase

Venezuela Might Have Cryptocurrency ATMs Again Soon

US Senators Working on Broad-Based Crypto Regulation

Abkhazia Extends Crypto Mining Ban Till End of Year

Is Bitcoin Heading Towards $25,000?

When is Cardano's next huge update coming?

How to recognize the best acquiring games?

What Is Proof Of Time and How It Works?

Ripple Exec - XRP was created as a "better Bitcoin"?

Wormhole Bridge further develops interoperability for Klaytn

Cryptocurrencies Explained Robo Inu Finance

BabyDoge Price in Green as Swap Testnet Finally Goes Live

Tether Is Setting New Standards For Communication

What Is Topgainer Complete Guide and Review About Topgainer

FTX US Lied About FDIC-Insured Products

LATOKEN Review The Ultimate Guide 2022

NFT Security 101 With Ledger x NFTevening

BTC Must Reach 1 Billion Wallets To Hedge Inflation

BORA Price Prediction 2022, 2023, 2024, 2025: Will BORA Go Up

Kryptomon To Launch An Exclusive Physital NFT Collection On Binance NFT

Will Ethereum Merge Buy the Crypto Market?

The Best Crypto Podcast: Top 5 to Check

Driving Bitcoin Adoption At Silverstone – Bitcoin Magazine

How To Denominate In Bitcoin Terms – Bitcoin Magazine

What’s Better: Privacy Coins or Bitcoin Privacy Tools?

Bitcoin below dollar 21000, Ethereum hold above dollar 1,500

Everything you need to know about mining crypto on a smartphone

Technical Indicators Suggest That BTC Has Established Its Bottom

Bitcoin, Ethereum and other fall, Polygon jumps

.jpg)

Will The Next Genesis Crypto Brokerage Fail?

.jpg)

Why dogecoin price is up today while other cryptos are trading low

.jpg)

Bitcoin Swings Below $17,000, Ethereum and Other Crypto Tokens Fall

.jpg)

Bitcoin, Ether, Solana, Other Crypto Prices Are Rising Today

.jpg)

Bitcoin over $17,000; Dogecoin, Solana and Shiba Inu fell up to 9%

.jpg)

How to start trading Crypto Markets

(1).jpg)

Bitcoin hits a one-month higher than expected US price

.jpg)

Price of Cardano (ADA) Will Experience Massive Drop as 2022 Ends

.jpg)

BTC Below $16,880 Support; Will It Follow a Positive Traction?

.jpg)

Top Trending Crypto on Binance, BNB Ousts Bitcoin on Second Position

.jpg)

Litecoin (LTC) Surpasses Shiba Inu (SHIB) in Market Cap

The presence of Bitcoin in the market is reaching all the time

3 good signs for the crypto industry in 2023

(1).jpg)

Bitcoin, Ethereum down 1%, other tokens fell

(6).jpg)

Latest Cryptocurrency Prices: Bitcoin, Ethereum, other mixed tokens

FTX claims that US$415 million in cryptocurrency has been stolen

.jpg)

How much of FTX debt has so far been recovered?

(1).jpg)

Over $3.8 billion will be stolen in cryptocurrency hacks in 2022

(2).jpg)

Bitcoin Exceeds $24,000 for the First Time Since June 20, 2022

(1).jpg)

Crypto Price Today: Coins like Bitcoin, Ethereum, and others decline

(5).webp)

Forecast of the Bitcoin price as BTC Rises 2.2%

What Will WBTC Worth In 2025

Bull Run Predicted To Continue For Bitcoin And Ethereum

.webp)

Bitcoin stays above $28,000 as Ethereum gains around 2%

Top Long-Term Cryptocurrency Investments

.webp)

Top Coins Land In Greens As Bitcoin Exceeds $28,000

Gains for Bitcoin, Ethereum, and other tokens

Bitcoin makes some progress, with Bitcoin SV leading the way

.webp)

Memecoin PEPE Becomes Top Gainer As Greens Dominate Charts

.webp)

Bitcoin and Ethereum underperform; XDC outperforms them all

.webp)

Bitcoin Is Still Under $30,000, but HBAR Is the Top Gainer

.webp)

Top Coins Land In The Red But Bitcoin Remains Above $27,000

After a court supports a grayscale ETF, bitcoin increases

.webp)

Bitcoin is still trading below $26,000, while Astar is the top gainer

Axie Infinity overtakes all other gainers as Bitcoin holds above $26,000

.webp)

Axie Infinity overtakes all other gainers as Bitcoin holds above $26,000

.webp)

Bitcoin Surpasses $27,000, with Flare the Top Gainer

.webp)

The top gainer as Bitcoin drops below $27,000 is Terra Classic

.webp)

Over the weekend, Bitcoin remains below $27,000

.webp)

Top Coins Like Bitcoin, Ethereum, and Others Land In Reds

.webp)

Bitcoin Cash surpasses $1,600 as Ethereum crosses it

PEPE is the biggest loser when Bitcoin Falls Below $28,000

.webp)

Ethereum, Bitcoin, and Other Popular Coins Drop in Value

.webp)

Ethereum, Bitcoin, and Other Popular Coins Drop in Value

What Is Web3 and Why Does It Matter?

What Are VIP Web3 Wallet?

WhiteBitcoin (WBTC) — Official Christmas & New Year Update

Related CryptoCurrencies

© 2026 WBTC Price All Rights Reserved.

-min.jpg)

(1)-min.jpg)

-min.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

-Offering-Risks-Retirement-Security-of-Americans,-Says-Labor-Department-Official.jpg)

.jpg)

.jpg)

-cost-might-ascend to-doller-0.08-level.png)

-min.jpg)

.jpg)

.jpg)

(5).jpg)

(1).jpg)

.jpg)

.jpg)

.jpg)

(3).jpg)

(2).jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

(1).jpg)

(2).jpg)

(1).jpg)

(2).jpg)

(4).jpg)

(1).webp)

(3).webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

(2).webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.png)

White Bitcoin

White Bitcoin Bitcoin

Bitcoin Bitcoin Cash

Bitcoin Cash Bitcoin SV

Bitcoin SV Bitcoin Gold

Bitcoin Gold