Latest News

A report of a current event, knowledge, information

.jpg)

How to start trading Crypto Markets

Only a person living under a rock would think that the cryptocurrency market does not need stricter regulations. The implosion of FTX, the collapse of the "stablecoin" TerraUSD, and the recent bankruptcy of crypto lenders and investors - all causing huge losses to investors - give enough evidence that digital assets should be controlled as almost less all other financial products and services. But there is a long-term risk that the path to compliance with constitutional principles, in the United States and around the world, may be difficult.

This risk is part of the varied and emotional response that crypto has evoked since its inception. Charlie Munger has called crypto tokens "part fraud and part fantasy," while many successful investors believe that tomorrow financial infrastructure will be based on crypto technology. Each camp believes that the government should act in their own way.

The unique genesis of crypto assets has also posed regulatory challenges. Unlike other financial innovations, bitcoin was launched globally and directly for retail investors, claiming that it would make transactions easier for those who -Cultural authorities are no longer effective. Since financial regulations are implemented nationally and largely through intermediaries, this emerging trend of "global markets" has challenged regulators because traditional instruments are not valid. provide investment opportunities, access to products or services, or banking-style products?

Security or commodity?

These factors, along with our fragmented financial system, overburdened by many regulators, have reduced the application of core, customer-centered rationality. Crypto supporters have sought to take advantage of the situation by arguing that a large part of digital assets should not be considered as securities, but as assets where the financial market does not have a federal regulator.

Twice, they expressed their choice not to voluntarily comply with the current regulations due to "legal uncertainty", when the real motivation is to avoid acceptance and its costs. They are right that US financial regulation is often expensive, and in some cases even so. irrationally, but there are areas where the law must be updated to take account of new technologies. But these have not been an excuse for lack of compliance, especially full and fair disclosure that makes the game competitive between consumers and consumers.

The legislative proposal has attracted attention recently, but the question is whether consensus can be reached behind the FTX. Crypto critics are likely to resist any legislative action that they may see as legislation that they do not trust and want to die because of its own limitations. Many enthusiasts believe that FTX shows that the problem is based on "central institutions" that do not live up to the promise of the decentralization of crypto and will contradict any declaration of our culture , a difficult process law among others - may have been undermined by his association with the now defunct Sam Bankman-Fried, founder of FTX and advocate of reform.

We, the regulators of both markets - one serving under President Obama and the other under President Trump - believe that government actions should not be based on one vision of the future or another, but on hard lessons won in the past. We also know that the search for a perfect plan carries a great risk of "Waiting for Godot". The reality is that billions of dollars a day of business are going on, while fraud and theft - in forms as old as trading and more recently as computer hacking - are still common thing. In our experience, it best to pursue things immediately in a systematic, consistent manner, both administratively and ethically.

We have three tips for US regulators:

Require all crypto intermediaries to implement basic customer protection. Despite the innovation and promise of blockchain technology, most crypto transactions are not recorded on chain but in traditional ledgers maintained by middlemen. But these companies say the products they sell are not required to register with the Securities and Exchange Commission or the Commodity Futures Trading Commission, which means investor protection depends on state laws written for telegraph time that is not enough, especially when shopping. and available leverage. Although we believe that most of their trading signals are safe, we need an acceptable method that does not rely on conflict resolution problems.

We believe that the SEC and the CFTC should provide the necessary regulations, including (1) the classification of client assets, (2) limits on lending, (3) restrictions on commercial enemies such as trading, (4) restrictions against fraud and deceit, including laundering (where a person trades with himself or his partners to increase the price of a stock or stock), and (5) requires governance.

These values can be easily derived from the current trends in our security and production processes. These two companies will also tell trading platforms: follow these basic rules for everything you trade if you are not registered with the SEC as a securities trader or with the CFTC as an interlocutor in production products. The company will not waive their right to dispute the registration requirement, but they will establish a temporary period in which the operator will not be closed for failure to register as long as he complies with the regulations that are base. This will assure platforms and their customers that operations will continue, more efficiently, while classification and other issues are resolved.

Although we believe that agencies can implement this policy using their current powers, that will not prevent Congress from repeating this process or pursuing other strategies to strengthen the law. This will improve investor protection as the legal framework (which we welcome) emerges.

Order to use "stablecoin". Stablecoin usage has exploded. Daily transactions worldwide using stablecoins, which are digital assets believed to peg their value to national currencies such as the US dollar, will regularly exceed $50 billion, with many facilitating crypto transactions . Stablecoins can improve payments in cases beyond crypto. But the truth is that they lack stability, which creates the risk of a bank run. The fact that exchanges like FTX offered returns on stablecoin deposits shows the risk between providers, crypto exchanges and investors.

Bank regulators should take the lead in creating regulations - a topic that each of us has written about recently - but the SEC and CFTC can help by requiring intermediaries to use only statstablecoins approved, providing another stable basis in the business market. At the very least, a regulated company that holds funds in high-quality liquid assets must provide them.

Continue with strong law enforcement. Crypto advocates complain about "regulation by coercion," but coercion is needed when so many industry players will use anything said negative to avoid or delay. acceptance. The success of the SEC in "initial financial offerings" or unregistered ICOs, starting in 2017, is important because such offerings violate the law of public offerings, often preventing them from offering even basic income or risk exposure. Both companies have taken various actions against unregistered or illegal products, Ponzi schemes and other scams, and they should continue to do so. But these efforts, targeted by their nature, should be supported by the broader measures of the kind we propose.

‘DeFi’ platforms

The policy we propose, which focuses on the parties involved, should not be interpreted as suggesting that we transfer freely to "DeFi" (decentralized money) platforms, which require eliminating intermediaries by providing software solutions, such as exchange or property lending programs. . , and public blockchains, on the contrary. Although their methods may be different, many of the same risks remain: fraud, hacking, the inability to work and the ability to modify the legal system. And most DeFi platforms, contrary to what they say, have managers and beneficiaries. It may take some creativity to implement the regulatory requirements for DeFi platforms, but we expect regulators to do the work. There is no doubt that middlemen will help them in this effort because they will have new incentives to ensure that their DeFi competitors provide equal protection.

For many years, we have shared the same views on crypto laws. Whatever the promise of this new technology, crypto should be subject to strict regulation. The fear that the United States will act in one way or another should not deter us either. We each had a plan - the SEC to crack down on ICOs and the CFTC to regulate swaps - while critics of the industry said that the US would have nothing to do with innovations that would move overseas. This does not happen; Instead, other countries followed our lead or wanted to. Those who invest - and risk - their hard-earned money in our financial markets should know that the rules of the game are fair and stable and that those who do bad things will be removed. We hope that Congress and our successors will be guided by common sense and provide these plans in the spirit of progress.

Related News

Bitcoin becoming less-risky as an investment, Novogratz says

Brazil is prepping an IPO for its state-run digital bank

Indian bank to offer crypto services across its 34 branches

The blockchain revolution is already here, say Alex and Don Tapscott

‘The cryptoruble is the future’ says Russian policymaker

Bitcoin’s Price Must Pass $40K to Halt Exodus of Traders:

Cape Cod's Largest Hospital Gets Bitcoin Donations Worth $800K

Spain May Soon Regulate “Risky†Bitcoin Street Ads

Brazil Approves First Latam Based Ethereum ETF

Google's New Cryptocurrency Ad Policy Goes Into Effect

Second Largest U.S. Mortgage Lender to Take Bitcoin Payments

Central Bank of Brazil Researches Creation of Digital Real

14 Suspects in Cryptocurrency Investment Scam Arrested in Taiwan

India Central Bank RBI Still Has Serious Concerns About Cryptocurrency

UK Post Office Adds Option to Buy Bitcoin via Easyid App

Bank of Russia Lists Crypto Companies Among Financial Pyramids

Major Cryptocurrency Exchanges Explore Entering Indian Crypto Market

Thailand to Develop Cryptourism Considers Issuing Utility Token

Grayscale Confirms Plan to Convert GBTC Into Bitcoin ETF

Goldman Sachs Predicts Ethereum Could Hit Dollar 8000 This Year

Indiana Star Bank Launches Bitcoin Trading Services

Venezuelan Court Rolls Back Seizure of More Than 1000 Bitcoin Miners

Bitcoin Dominance Slides Below 40 Percent for First Time in 6 Months

Leading Supermarket Chain in Croatia Introduces Crypto Payments

ECB Paper Marks Success Factors for CBDCs Digital Euro

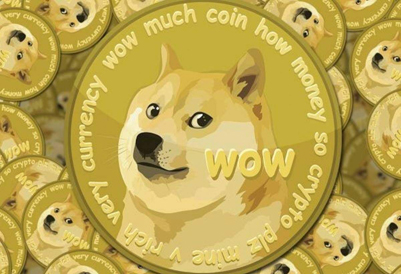

Dogecoin Soars After Elon Musk Announces Tesla Will Accept DOGE

Leading Supermarket Chain in Croatia Introduces Crypto Payments

Chinas Xinhua News Agency to Issue NFTs Despite Crackdown on Crypto

Former Finance Secretary Doubts Indian Government Understands Crypto

Indian Authorities Raid Cryptocurrency Exchanges for Tax Evasion

Crypto Tops Investor Threats for US Securities Regulators

New Spanish Regulations to Target Crypto Investment Ads

Crypto Users and Exchanges Must Now Report Transactions in Colombia

Colombia Registers First Real Estate Purchase With Bitcoin

Indian Parliament Member Clarifies Legal Status of Cryptocurrency

Wells Fargo Cryptocurrency Has Entered Hyper Adoption Phase

Venezuela Might Have Cryptocurrency ATMs Again Soon

US Senators Working on Broad-Based Crypto Regulation

Abkhazia Extends Crypto Mining Ban Till End of Year

Is Bitcoin Heading Towards $25,000?

When is Cardano's next huge update coming?

How to recognize the best acquiring games?

What Is Proof Of Time and How It Works?

Ripple Exec - XRP was created as a "better Bitcoin"?

Wormhole Bridge further develops interoperability for Klaytn

Cryptocurrencies Explained Robo Inu Finance

BabyDoge Price in Green as Swap Testnet Finally Goes Live

Tether Is Setting New Standards For Communication

What Is Topgainer Complete Guide and Review About Topgainer

FTX US Lied About FDIC-Insured Products

LATOKEN Review The Ultimate Guide 2022

NFT Security 101 With Ledger x NFTevening

BTC Must Reach 1 Billion Wallets To Hedge Inflation

BORA Price Prediction 2022, 2023, 2024, 2025: Will BORA Go Up

Kryptomon To Launch An Exclusive Physital NFT Collection On Binance NFT

Will Ethereum Merge Buy the Crypto Market?

The Best Crypto Podcast: Top 5 to Check

Driving Bitcoin Adoption At Silverstone – Bitcoin Magazine

How To Denominate In Bitcoin Terms – Bitcoin Magazine

What’s Better: Privacy Coins or Bitcoin Privacy Tools?

Bitcoin below dollar 21000, Ethereum hold above dollar 1,500

Everything you need to know about mining crypto on a smartphone

Technical Indicators Suggest That BTC Has Established Its Bottom

Bitcoin, Ethereum and other fall, Polygon jumps

.jpg)

Will The Next Genesis Crypto Brokerage Fail?

.jpg)

Why dogecoin price is up today while other cryptos are trading low

.jpg)

Bitcoin Swings Below $17,000, Ethereum and Other Crypto Tokens Fall

.jpg)

Bitcoin, Ether, Solana, Other Crypto Prices Are Rising Today

.jpg)

Bitcoin over $17,000; Dogecoin, Solana and Shiba Inu fell up to 9%

(1).jpg)

Bitcoin hits a one-month higher than expected US price

.jpg)

Price of Cardano (ADA) Will Experience Massive Drop as 2022 Ends

.jpg)

BTC Below $16,880 Support; Will It Follow a Positive Traction?

.jpg)

Top Trending Crypto on Binance, BNB Ousts Bitcoin on Second Position

.jpg)

Litecoin (LTC) Surpasses Shiba Inu (SHIB) in Market Cap

The presence of Bitcoin in the market is reaching all the time

3 good signs for the crypto industry in 2023

(1).jpg)

Bitcoin, Ethereum down 1%, other tokens fell

(6).jpg)

Latest Cryptocurrency Prices: Bitcoin, Ethereum, other mixed tokens

FTX claims that US$415 million in cryptocurrency has been stolen

.jpg)

How much of FTX debt has so far been recovered?

(1).jpg)

Over $3.8 billion will be stolen in cryptocurrency hacks in 2022

(2).jpg)

Bitcoin Exceeds $24,000 for the First Time Since June 20, 2022

(1).jpg)

Crypto Price Today: Coins like Bitcoin, Ethereum, and others decline

(5).webp)

Forecast of the Bitcoin price as BTC Rises 2.2%

What Will WBTC Worth In 2025

Bull Run Predicted To Continue For Bitcoin And Ethereum

.webp)

Bitcoin stays above $28,000 as Ethereum gains around 2%

Top Long-Term Cryptocurrency Investments

.webp)

Top Coins Land In Greens As Bitcoin Exceeds $28,000

Gains for Bitcoin, Ethereum, and other tokens

Bitcoin makes some progress, with Bitcoin SV leading the way

.webp)

Memecoin PEPE Becomes Top Gainer As Greens Dominate Charts

.webp)

Bitcoin and Ethereum underperform; XDC outperforms them all

.webp)

Bitcoin Is Still Under $30,000, but HBAR Is the Top Gainer

.webp)

Top Coins Land In The Red But Bitcoin Remains Above $27,000

After a court supports a grayscale ETF, bitcoin increases

.webp)

Bitcoin is still trading below $26,000, while Astar is the top gainer

Axie Infinity overtakes all other gainers as Bitcoin holds above $26,000

.webp)

Axie Infinity overtakes all other gainers as Bitcoin holds above $26,000

.webp)

Bitcoin Surpasses $27,000, with Flare the Top Gainer

.webp)

The top gainer as Bitcoin drops below $27,000 is Terra Classic

.webp)

Over the weekend, Bitcoin remains below $27,000

.webp)

Top Coins Like Bitcoin, Ethereum, and Others Land In Reds

.webp)

Bitcoin Cash surpasses $1,600 as Ethereum crosses it

PEPE is the biggest loser when Bitcoin Falls Below $28,000

.webp)

Ethereum, Bitcoin, and Other Popular Coins Drop in Value

.webp)

Ethereum, Bitcoin, and Other Popular Coins Drop in Value

What Is Web3 and Why Does It Matter?

What Are VIP Web3 Wallet?

WhiteBitcoin (WBTC) — Official Christmas & New Year Update

Related CryptoCurrencies

© 2026 WBTC Price All Rights Reserved.

-min.jpg)

(1)-min.jpg)

-min.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

-Offering-Risks-Retirement-Security-of-Americans,-Says-Labor-Department-Official.jpg)

.jpg)

.jpg)

-cost-might-ascend to-doller-0.08-level.png)

-min.jpg)

.jpg)

.jpg)

(5).jpg)

(1).jpg)

.jpg)

.jpg)

.jpg)

(3).jpg)

(2).jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

(1).jpg)

(2).jpg)

(1).jpg)

(2).jpg)

(4).jpg)

(1).webp)

(3).webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

(2).webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.png)

White Bitcoin

White Bitcoin Bitcoin

Bitcoin Bitcoin Cash

Bitcoin Cash Bitcoin SV

Bitcoin SV Bitcoin Gold

Bitcoin Gold